|

23 February 2015

Posted in

Special research

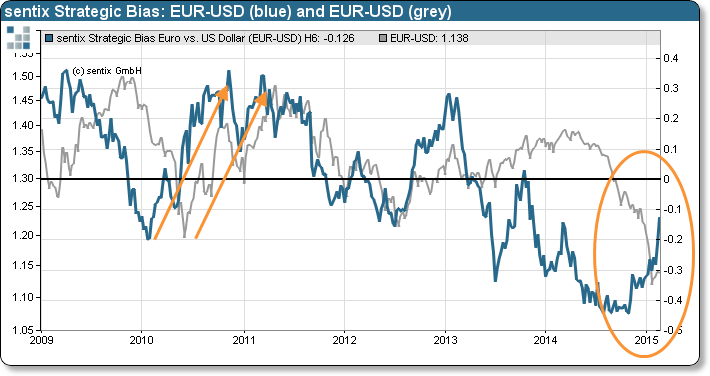

Confidence in the euro rises strongly. This is shown by the increase in the sentix Strategic Bias for the EUR-USD currency pair, one outstanding result of the latest sentix Global Investor Survey. The index reaches its highest reading since November 2013. At the same time, more and more investors (now 39%) expect Greece to leave the euro. The consequent attitude of the European partners towards the new Greek government has thus served as a support for the common currency.

The sentix Strategic Bias for EUR-USD goes up by 8 percentage points to -12.6% and climbs to its highest reading since November 2013 (see graph). This is shown by the latest sentix Global Investor Survey. The strong increase of this index – which measures investors’ 6-month expectations and thus their conviction for the market – is a clear signal that confidence for the common currency is returning. Since its low last autumn the Strategic Bias for EUR-USD has been gaining 30 percentage points now. Investors change their minds after having favoured the US dollar for a long time.

At the same time, more and more investors expect Greece to leave the euro within the next twelve months. This, in turn, is reflected by the sentix Euro Break-up Index for the country which increases from 32.0% to 39.0% this week – a reading that stands for the share of investors which currently anticipate a “Grexit”. Obviously, the consequent stance of the European partners towards the new Greek government has paid off for the euro. On the one hand it has an effect of discipline on all euro-zone countries, on the other hand it makes a “Grexit” likelier – which would take a burden off the common currency.

The new confidence should lead to a stronger euro in the medium term, especially versus the US dollar. This is demonstrated by the developments of the past. At the beginning of 2013, for instance, when the Greek situation was also weighing on the euro, the Strategic Bias rose in a similar fashion as now – and some months later EUR-USD followed suit (see again graph)!

Background

The sentix Strategic Bias which is surveyed since the beginning of 2001 reflects investors’ 6-month expectations and thus their strategic view and basic conviction for a market. Because of this characteristic it serves as a directional indicator which usually leads the corresponding market’s development. The sentix Euro Break-up Index for Greece measures the share of investors who expect the country to leave the euro zone within the next twelve months. The index was introduced in June 2012 on a monthly basis. Since the end of January 2015 it is even surveyed on a weekly basis.

The current sentix Global Investor Survey was conducted from February 19th to February 21st, 2015. 986 individual and institutional investors took part in it.