|

23 August 2016

Posted in

Special research

The monthly sentix indicator measuring investors’ sentiment for emerging markets equities points towards rising stock indices. Investors continue to show an unbridled willingness to purchase emerging markets stocks as the sentix index marks the highest reading since three years ago. Developments of economic expectations and commodity prices fire investors’ imagination.

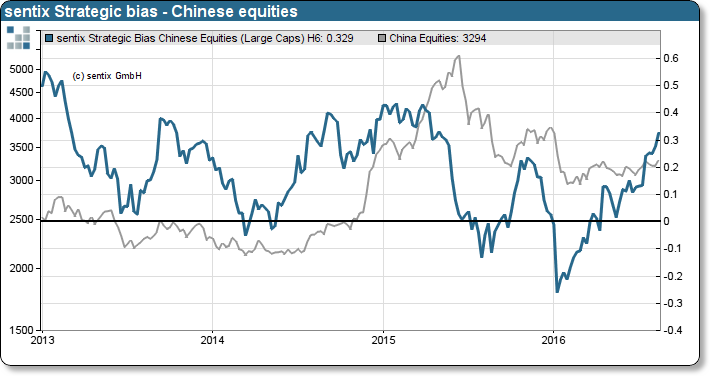

In August, the sentix Asset Class Sentiment for Emerging Markets stocks climbs to the highest value since May 2013. Rising commodity prices and recovering expectations on the economic development of emerging markets increase investors’ appetite for emerging markets equities. Especially China’s economic vitality boosts confidence. In contrast, just a year ago (August 2015) investors’ sentiment hit record lows as fears about a “hard landing” of China’s economy inundated financial markets. Today, that’s not an issue anymore. Respectively, our indicator shows the most dynamic 12 months increase since the inception of the Asset Class sentiment indices in 2007.

However, the emerging markets sentiment has not yet reached overbought territory (refer to chart). The outlook is promising that investors continue to invest in equities due to their rediscovered passion for emerging markets. Ultimately, emerging markets equity prices could continue to increase even further.

Background

sentix Asset Classes Sentiment Emerging Markets Equities is polled among individual and institutional investors since 2007 via the sentix Global Investor Survey. The corresponding survey is open around each third Friday of a month. Investors are asked about their medium-term price expectations for the asset class. These expectations tend to lead price developments as rising preferences signal increasing readiness to buy (and vice versa). Extreme readings of sentix Asset Classes Sentiment indicators often mark the end of a price movement and thus signal increasing chances/ risks.

In the latest sentix Global Investor Survey was conducted from 18-August-2016 to 20-August-2016. 978 individual and institutional investors took part in it.