|

19 April 2017

Posted in

Special research

Die Stimmung zu Gold ist so gut wie lange nicht. Das gelbe Edelmetall profitiert von Kriegsängsten rund um Nord-Korea wie auch von der anstehenden Schicksals-Wahl in Frankreich. Die Luft für weitere Kursanstiege wird damit dünn.

The signal for gold is bullish due to the result of the latest sentix global investors survey with more than 1.000 investors. With a value of plus 39 percentage points the sentiment taps in the historical context at the upper end of the scale. The measured index level has now reached its peak in 2017; beginning of July 2016 this value has been exceeded before.

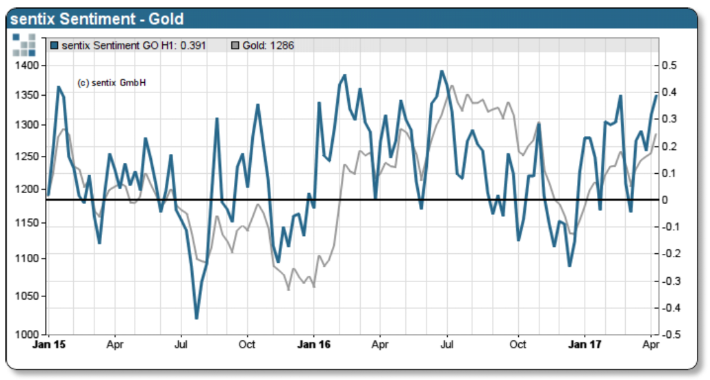

sentix sentiment gold and gold price in USD (ounce)

The force measuring in South-East-Asia, between North Korea and the United States has re-heated the good mood. The French election gets into investors’ focus at the same time. The necessity of self-protection for unforeseen election result increases. Precious metals also profit from this as a “safe haven”. The Behavioral Finance angle takes this sentiment signal for a contrarian point of view. In the past, an overheated mood, regular led to corrections or top-level forming. Due to the extreme data constellation, it is supposed to be hard for gold to break the mark of 1.300 USD sustainably within the following weeks. The last CoT-Report shows that investors’ portfolios do not keep huge long positions as still seen in the middle of 2016. This is a positive argument for the gold market and should avoid an enormous correction for the precious metal.

Background

The sentix Sentiment indices, which capture investors’ 1-month expectations for a broad range of financial markets, are calculated on a weekly basis since 2001 as part of the sentix Global Investor Survey. The sentix sentiment reflects human emotions – between greed and fear – of market participants. Negative sentiment extremes are usually a straight indication for rising prices. High optimism, in contrast, may be a warning signal for an upcoming market consolidation. A sentiment divergence mostly indicates more important turning points.

The latest sentix Global Investor Survey was conducted from 13-April to 15-April-2017 with 1.082 retail and institutional investors.