|

23 March 2015

Posted in

Special research

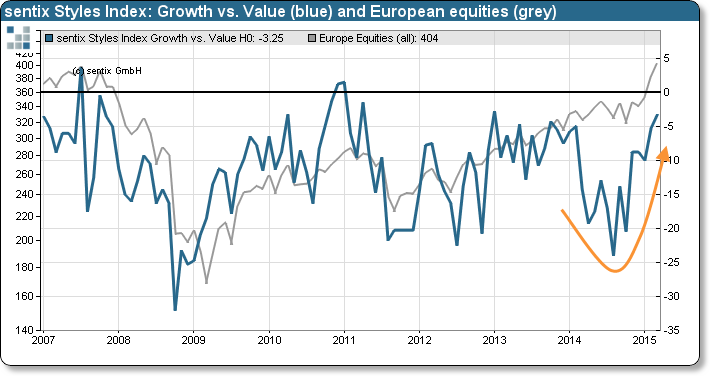

According to the latest sentix data, investors’ preferences for growth stocks climb to a 26-month high. This reflects investors’ increasing risk appetite. Market participants obviously have left their quest for safety behind – a stance which was extremely pronounced during last fall.

In March, the sentix Styles Index: Growth vs. Value which measures investors’ preferences for growth against value stocks increases by two to -3.25 points. This is its highest reading since January 2013. Worth of note is the development of the indicator also because in October 2014 it had still stood at a level that was previously known only from the height of the financial crisis in 2008 and 2009 (see graph).

Since last autumn investors’ bias towards growth stocks has increased markedly. It now stands even above the average of the indicator being surveyed since 2004. The returning interest for this kind of asset is a sign of increased risk appetite – although the vagaries stemming from the unclear Greek situation and the Ukrainian crisis prevail.

The indicator adds to a series of other sentix data which are rather bullish for equity markets: For weeks now the basic confidence for the asset class shows strong readings. Also, economic expectations for the euro zone, and for the world as a whole, have risen strongly over the last months.

Background

The sentix Growth vs Value Index is part of the “sentix Styles Index” family of indicators. It shows to what extent investors prefer growth over value stocks at a given point in time. Value stocks are in stronger demand when investors look for safety – as the performance of these stocks usually is less volatile because of high liquidity and relatively stable earnings. In contrast, investors prefer growth stocks when their risk appetite is relatively high.

The indicator family “sentix Styles Index” is surveyed around each third Friday of a month. It comprises eight indices on investors’ preferences on equity and bond markets as well as three indicators regarding investors’ risk preferences.

The current survey was conducted between March 19th and March 21st, 2015. 1018 investors took part in it.