|

31 August 2015

Posted in

Special research

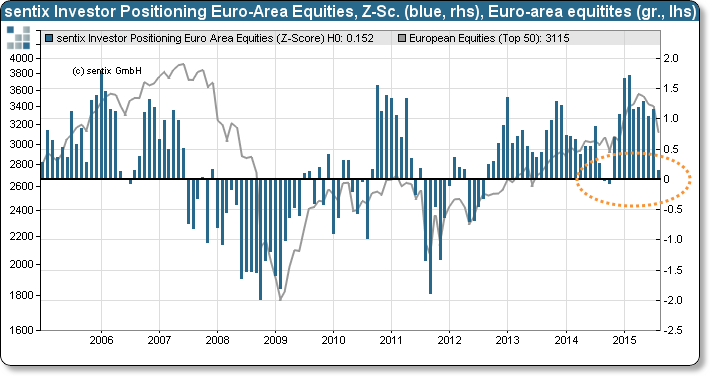

The latest sentix data show that investor positioning in euro-zone shares has strongly fallen. It now stands close to its long-term average. Consequently, the immediate dangers for the asset class are clearly smaller than before – not more, but also not less than that.

The sentix Investor Positioning for euro-area equities drops in August from 1.15 to 0.15 standard deviations (for explanations see “Background” below). Against the backdrop of the latest erosion of share prices investors have thus almost completely cut to zero their over-investments which could be observed over the previous months. The positioning in euro-zone equities is now only slightly higher than its long-term average (see graph). With this, the dangers which stem from a high positioning (over the breadth of the market) are banned at the current juncture.

At the same time, investors’ basic conviction for the asset class weakens. This receding strategic confidence does not serve as an incentive for market players to quickly restore their positions. Overall, we thus rate our latest positioning data as neutral – and that is, after all, an improvement vis-à-vis the situation observed since last autumn!

Hintergrund

The sentix Investor Positioning Euro-Area Equities is polled among individual and institutional investors since 2002 via the sentix Global Investor Survey. The corresponding survey is open around each fourth Friday of a month. The index measures how strongly market participants are invested in euro-zone stocks. To be precise, investors are asked about their positioning relative to their benchmark/ neutral investment. In order to obtain the index discussed here the survey results are then transformed into z-scores. Z-scores are standard deviations from the mean of a given sample. A reading of +1, for instance, here means that investors’ positioning stands one standard deviation above its long-term average, a value of zero corresponds exactly to this average. sentix Investor Positioning thus signals positioning risks which usually materialize when market developments run against it.

The current survey in which 981 individual and institutional investors participated was conducted from August 27 to August 29, 2015.