|

17 July 2017

Posted in

Special research

Fears of a flare-up of a new dieselgate at Daimler drives the sentiment of investors for the entire European automotive sector to a 24-month low. However, the fear of investors seems to be exaggerated. The sector index performance hardly showed any reaction. From a behaviour-oriented approach an anticyclical opportunity arises from these circumstances.

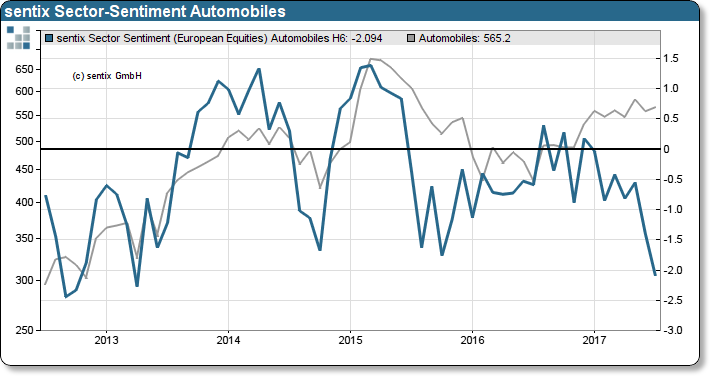

The sentiment for automobile stocks in Europe is in a sorry state. The July sector sentiment for the automobile sector shows that investors have developed a high level of scepticism for the automotive industry. The sector sentiment is currently the worst of all 19 STOXX sectors and marks a 24-month low. With a Z-score of -2.1, it is almost as low as in April 2013. Following this low point, a clear recovery began.

Investors are increasingly reacting to two factors. On the one hand, the negative news about the Daimler share has a negative impact on the sector. Investors estimate a second dieselgate as a huge burden for the entire sector. The investors now transfer their experiences they have made from the VW scandal to the next candidate (keyword “representativeness heuristic”).

sentix Sector Sentiment Automobiles vs. STOXX 600 Automobiles

On the other hand, investors evaluate a second stress factor for the export-oriented industry: As a result of the recent strengthening of the euro, investors see a risk that the business prospects of the car manufactures might deteriorate. The result is a tremendous force in sentiment, but this is not reflected in the current STOXX 600 sector index performance.

From the point of view of behavioral finance, investors' outrage in relation to market price behavior seems to be far too strong. In historically comparable constellations, such a sentiment signal subsequently stimulates a dynamic recovery of the sector. This is also to be expected for the present constellations. Therefore, from our anti-cyclical analysis, the traffic light for the automobile sector switches to green.

Background

sentix Sector Sentiment is a monthly survey conducted since 2002 among individual and institutional investors as part of the sentix Global Investor Survey which runs on the second Friday of each month. Investors are asked about their 6-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalized and calculated as z-scores. Z-scores are standard deviations from the mean of a given sample. A value of +1 for an industry sentiment says, for instance, that the expectations for the industry stand one standard deviation above the average expectation for all sectors.

The current sentix Sector Sentiment survey ran from 13-July to 15-July-2017 and 1.119 individual and institutional investors took part in it.