08 August 2019

In the German language, the word "Rente" not only stands for the pension benefits of pensioners, but is also another term for fixed-income securities (bonds). These were or are securities that offer the owner an annual, usually fixed rate of interest - like a pension. This is no longer the case at present. The deep slide of certain segments of the bond market into negative interest rates, for example german federal bonds, has massive consequences, which will be pointed out and discussed here.

In recent months the bond markets have become remarkably dynamic. In the following, we will look at the market for German government bonds to illustrate the development. For example, the yield on 10-year Bunds has fallen from +0.20% to -0.56% since 1 January 2019. The decline in interest rates for 30-year bonds (from 0.85% to -0.06%) has a similar extent. Whatever the cause of this massive fall in interest rates, it must be discussed and it will have massive consequences.

Negative business

After all, what does this mean for those investors who today acquire German government bonds and hold them to maturity?

If an investor today invests his money for three years in government bonds, he "receives" a negative interest rate of -0.89%. That is, he loses within three years surely 2,9% of his money. If, for example, he buys the 0% federal bond with a maturity of 7.10.2022 today for 102.89%, he will receive only 100% back at maturity. This is not however the whole truth, because the investor must consider also still the inflation. This is currently 1.7% in Germany. This adds up to a purchasing power loss of around 5% within three years, provided the inflation rate remains unchanged. Makes a stately loss of value of more than 8% within 3 years!

The calculation looks even starker if one were to buy 10-year federal bonds today. A non-interest-bearing federal bond with maturity 15.8.2029 currently costs 105.825%, so that a guaranteed minus of 5.8% is already certain for the investor at the time of purchase. In addition the inflation comes of 1-2%, so that one will lose with BUNDS within 10 years loosely 15-20% - with federal guarantee. In the meantime, 30-year bonds also have a negative yield, so that here, too, at 1.5% average inflation in 30 years, a minus of about 36% occurs.

One can point it also somewhat differently: What does it mean for a person who is 50 years old today and is worried about his retirement provision? In Germany, a man has a statistical life expectancy of around 30 years at the age of 50. So you can certainly say that a man of fifty today is unlikely to achieve a return on his life with government bonds. Not only death is certain, but also the missing yield!

But it goes still crazier. In 2017, the Austrian government issued a bond with a maturity of one hundred years. The bond is still yielding an incredible 0.75% and has already brought its owners price gains of over 60% this year. An investment for real optimists!

Who buys something like this?

One inevitably wonders who is currently buying these bonds? If investors buy investments that promise them a certain loss (!), then (besides the fact that some investors have to hold bonds due to regulatory requirements, e.g. banks / keyword: "LCR") there can only be one of two reasons to explain this.

Either these investors are victims of a speculative exaggeration and are subject to the "greater fool" syndrome. This means that investors buy overpriced assets because they believe they can resell them to another "fool" at even higher prices. The resulting price bubbles can increase even if the overvaluation is generally recognised. However, this does not change the basic finding that such a bubble will burst with a probability that it will cause devastating damage to investor portfolios.

The second reason would be that the valuation of the market is indeed justified. Fortunately, the valuation of bonds is comparatively simple compared to equities. Firstly, because bonds have a fixed term and are therefore not predicted for an indefinite future, but only for a foreseeable period. On the other hand, because there are essentially only a few determining factors for an appropriate interest rate level.

The main factors are the future real growth rate of the economy and future inflation. In the case of non-government bonds, liquidity and creditworthiness aspects also play a role.

So what does it say if government bonds with a residual maturity of up to 30 years have a negative yield? Either future growth rates are clearly negative with moderate inflation or growth is moderate with a marked deflationary trend. Because the formula for interest rates is simplified: interest = growth + inflation. And if to the left of the equation there is a value less than or equal to zero, the term to the right must also be less than or equal to zero. In all other cases the bond market would be grossly misvalued.

Investors, however, highly invested

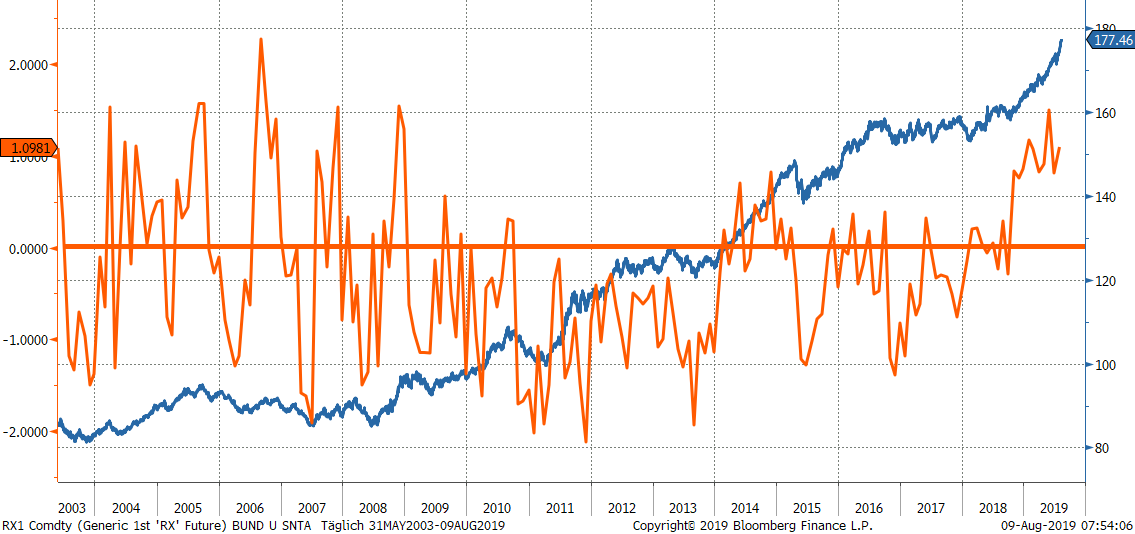

Despite these considerations, according to sentix positioning data, investors are as invested in bonds as they were in 2008. For years, investors were afraid of rising interest rates and an aversion to low nominal interest rates, but this has changed. In their omnipotence belief in the central banks, investors have opened up the bond market anew and are now either subject to speculative exaggeration - or they entrust their money to states that will soon face massive economic problems.

sentix Positioning of investors in euro bonds (institutional; Z scores)

What does this mean for investors?

For a long-term investor in Bunds, the current environment means a guaranteed loss of capital. It is unclear whether this will even be disproportionately high in the short term because the market is correcting its overvaluation. Or whether it takes place in an environment of greatest economic upheaval. Because an economic downturn lasting more than 30 years (!) or a permanent deflation is likely to have massive social consequences. Not to mention the risk that artistic creations such as the euro will not survive such a phase.

Even the investors, who look for their salvation in other forms of investment, must argue with the question, which message the bond market sends up-to-date. Either interest rates rise significantly again, which will also influence other forms of investment in terms of valuation.

Or the crisis symptoms expressed in interest rates in the bond market are correct. Then the stability of the financial system, the future of the banking and insurance industry and the profitability of companies are at risk.

But the central banks will fix it!

Will you? We do not believe so. Because in the current interest rate development there are increasingly limits for the central banks to influence the economy via the bond market by further interest rate cuts. The key words are yield curve and roll down effect.

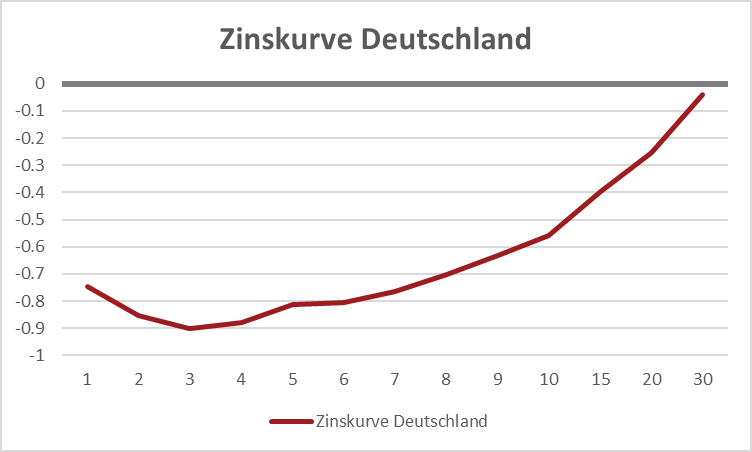

There is not one interest rate, but each remaining term has its own interest rate. This is called the yield curve. Normally, longer interest rates are higher than short-term ones, which is logical, since an investor who commits himself longer also has a higher uncertainty in development and wants to be compensated for this with higher interest rates. A yield curve, where 10-year interest rates are quoted over 2 years, is called "steep". A curve where interest rates are roughly similar is called "flat". And a curve where short interest rates are even higher than long-term ones is called "inverse". An inverse curve is illogical according to the above explanations and is almost always a sign of future economic problems.

Current yield curve of federal bonds (interest rates according to remaining maturities of the bonds)

For investors, however, a "steep" yield curve has another special significance. Because if I invest for 10 years today and wait a year, my bond is only a nine-year bond in one year. But if the interest rates are lower for short maturities, then as an investor I achieve an additional return in addition to my nominal return. Because the price of a bond depends on the interest rate level and the remaining term. The lower the interest rate, the higher the price. This yield is called "roll down" yield. Due to the shortening residual term, the investor "rolls down" the yield curve so to speak and can generate an additional return. However, if I hold the bond until maturity, this return disappears again, because the total return on purchase is fixed. But if I sell the nine-year bond and reinvest it for 10 years again, I can keep this yield. The investor who does this, however, also retains the full interest rate risk in the long term. Because the longer the term, the higher the price fluctuations of a bond and thus the risk in the event of a rise in interest rates.

So while the risks of a rise in interest rates become smaller every year for an investor who holds his bond to maturity, they remain constant for an investor who wants to take advantage of the "roll down".

This "roll down" yield is an important component of the bond yield. In times of low interest rates and a "steep" yield curve, this additional return can easily amount to 3-5 times the actual interest income. Professional investors take advantage of this with corresponding eagerness.

The end of the "roll down" yield

In the meantime, however, two developments have occurred that are making the roll down yield disappear. On the one hand, the yield curves are flattening massively on a global scale. In the USA, the interest rate gap between 10-year and 2-year bonds is only 0.1%, while it is 0.28% for federal bonds. The flatter the curve, the lower the "roll down" yield.

On the other hand, yields are becoming lower, i.e. the interest rate increasingly negative. This means that more and more "roll down" is consumed by the negative base rate. The strength of this effect can now be seen in three-year bonds. The base yield is -0.9%, which is blatant enough. But since two-year bonds are at -0.75%, there is even a negative "roll down" return. Because in one year my bond is quoted at a "higher" yield (which at -0.75% sounds kind of funny). That is, taking the "roll down" into account, the investor even loses 1% and not just 0.9%.

With 10-year Federal bonds, there is still a low positive "roll down" of around 0.5% p.a. However, we strongly doubt whether this also justifies the price risk. This is because such a federal bond would record a price loss of around 4% if interest rates rose by only 0.5% (i.e. from -0.56% now to just under 0%!). 4% risk for a miserable 0.5% return? Not a good risk-reward ratio.

Further interest rate cuts possible, but dangerous

Of course, the ECB could try to push the interest rate for short-term investments further in order to redistribute the yield curves in this way and create new "roll down" earnings. But this will be difficult to impossible for two reasons.

On the one hand, the base yield is pushed further into the negative and more and more "roll down" earnings are "eaten up" in this way. The investor thus receives less and less yield. This is a classic case of diminishing marginal utility, as can be found again and again in the economy. In addition, the banking system, which is already suffering massively from negative interest rates, would be further weakened.

On the other hand, alternative forms of investment are becoming more and more interesting. Not only stocks and real estate, but increasingly gold as well. Gold offers a secure zero interest rate. Less storage costs of approx. 0.3% p.a., it is becoming more and more of an alternative, especially as it simultaneously represents a hedge against the emerging crises of the financial system. But cash is also becoming interesting. Even large investors may be tempted to hoard cash rather than pay such negative interest rates.

But hoarding cash is the exact opposite of what the ECB actually wants to achieve. Because this money would be withdrawn from the credit cycle and could cause massive imbalances in the money cycle.

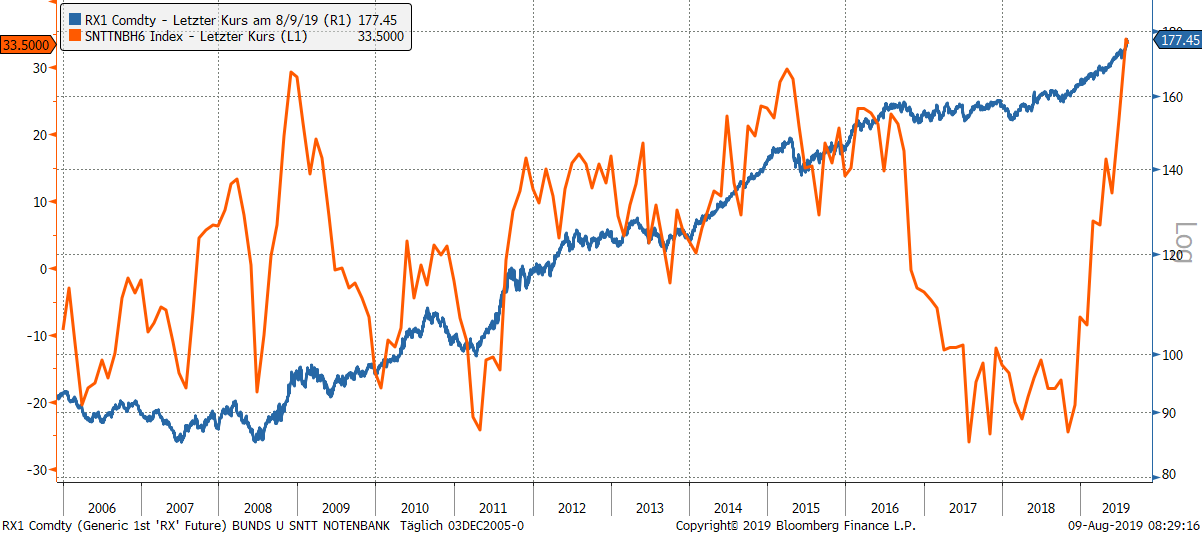

According to the sentix Topic Barometer, investors are currently relying heavily on the card of central banks. They think that the central banks will continue to depress interest rates and thus reverse the economic downturn. In view of the above, we hope that the central banks will not take this path. It leads to a dead end and, apart from gigantic financial bubbles and a major financial crisis in the future, not much could be achieved.

sentix Theme Barometer Central Bank Policy and Price Development Bund Future

The governments are in demand

Instead, we are assuming that there will be a rethink and that we are facing a foreseeable end to austerity policy. If investors lose 36% within 30 years, as described above, a borrower could make a corresponding long-term financing and would buy it with a 36% advantage. A long-term government investment over 30 years would be subsidised by investors with a full 36%!

This is tempting and at a time when (a) more and more planned economies are operating and (b) climate change, the refugee crisis and the fight against recession are also bringing to light many more or less meaningful fields of use for government expenditure, it seems very likely to us that there will be a reversal in politics and thus a rise in government debt, including in Germany. This would increase the supply of bonds again and increase the probability of inflation. And ultimately this will very likely drive long-term interest rates upwards again.

In this scenario, we would therefore expect noticeable increases in interest rates and corresponding price losses on the bond market.

Conclusion

Just because the money no longer works (negative interest rate), one should not wait for statistical death (guaranteed losses in long-term buy & hold investment). Never before have federal bonds been as expensive and risky as they are today. At the same time, according to sentix positioning data, investors have invested as much in bonds as they did in 2008. There is a threat of massive price losses.

However, investors should also address the question of whether the message of the bond market does not also contain indications of coming major upheavals in the economy and / or inflation. Then there would not be a bubble in bonds, but a massive risk signal, e.g. for equity investors.

And last but not least, investors should realize that the central bank's weapons are becoming increasingly dull and that the discovery of this circumstance is imminent. Mathematics cannot be manipulated. If investors realise that there is a risk of certain losses under virtually all circumstances when investing in bonds, they must expect to flee into cash, gold and similar investments. It remains to be seen whether the troubled financial system will be able to withstand this.