How to use the indicator

The sentix Maturity Preference Index is surveyed exclusively among institutional investors on a regular basis around the fourth Friday of each month as part of the sentix Global Investor Survey. The index family comprises two groups of sentiment indicators for the Bund market:

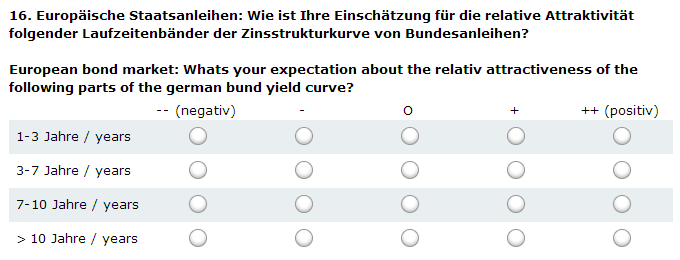

- Indicators for assessing the relative attractiveness of different maturity bands

- Indicators that reflect investors' expectations regarding the development of the yield curve for Bunds.

Basically, the indicators represent an additional source of information on the emotions, thoughts and actions of investors and in this sense complement the range of sentix indices, which aim to describe investor behaviour (in terms of their emotions, thoughts and actions) as comprehensively as possible at any point in time. From the overall view of investors, trends or even contradictions can often be uncovered.

For example, expectations of the yield curve can be compared with economic expectations - indicators that can also be found in the sentix data. If there are inconsistencies here - e.g. the expectation of a steepening of the yield curve with falling economic expectations - this would be an indication to conduct further causal research in order to better understand the thought processes of investors and to be able to derive the implications for the upcoming market movements. In the present case, for example, an imminent intervention by the central bank could already be reflected in expectations about the yield curve, whereas it is not yet included in economic expectations.

Furthermore, the indices can also be used directly as directional indicators for developments in the federal bond markets. In the following, this type of possible application is briefly explained for each of the two subgroups of the indicator family.

sentix attractiveness indices for the different maturities of Bunds

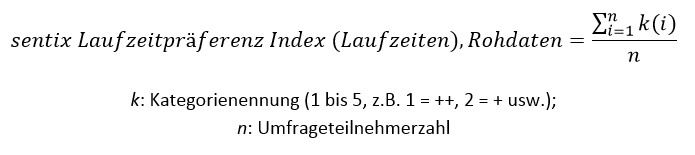

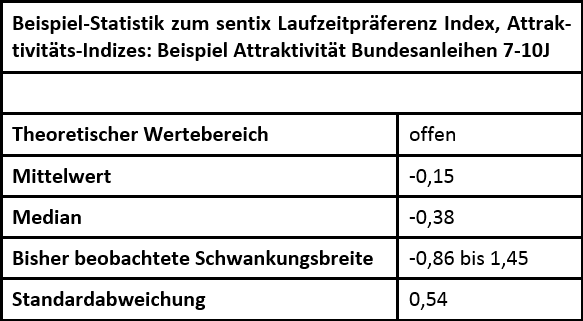

This subset of the sentix Maturity Preference Index refers to the maturity bands 1-3 years, 3-7 years, 7-10 years and greater than 10 years, each for Bunds. The indices reflect investors' assessment of the relative attractiveness of the maturity segments at a given point in time. The fact that this is a relative measure is significant for the interpretation of the indices. This is because it follows that the indicators are ideally used to estimate the development of the relative performance of the respective maturity band under consideration and not to forecast their absolute performance.

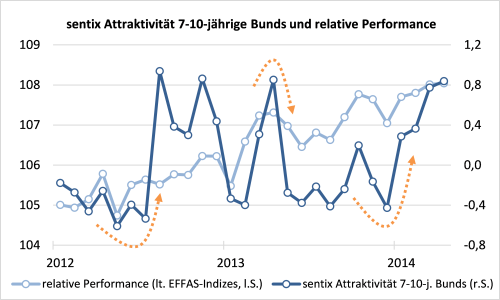

The sentix attractiveness indices can therefore be used as directional indicators to forecast the relative performance of the respective maturity band under consideration. Figure 1 shows an example of this. The sentix attractiveness index for 7-10-year Bunds is shown there. This is compared with the relative performance of the maturity band, which is calculated as the performance of the band under consideration in relation to the average performance of the other three maturity bands. The sentix indicators tend to show a slight lead over the relative performance, from which their property as a directional indicator and forecasting tool is derived. It is worth noting here that particularly strong, impulse-like movements in the sentix index often mark the start of a trend in relative performance that lasts several months (see orange dashed arrows).

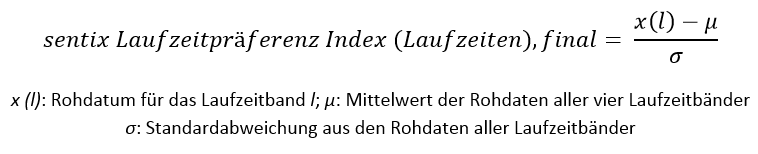

The sentix attractiveness indices are calculated (in cross-section) as Z-scores and are thus also relative measures in their construction. The conversion into Z-scores makes sense because there can be general level shifts over time, which can lead to the (absolute) raw value of the index no longer indicating the differentiation of investors between the individual maturity bands pronouncedly enough at the current margin. The Z-scores then take over (as a relative measure) this task of representing the still existing differentiation of investors between the maturity bands.

The sentix curve barometer for the yield curve of German federal bonds

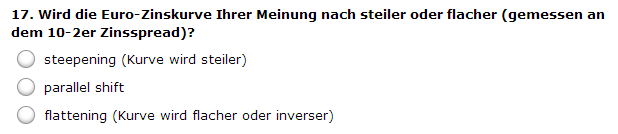

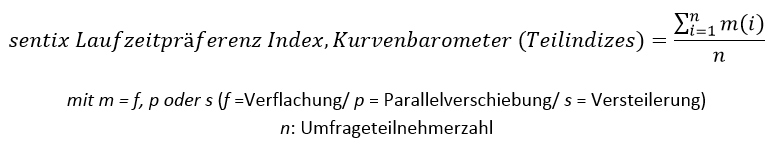

The indices for the sentix curve barometer are determined monthly in parallel to the attractiveness indices described above. In order to collect them, a separate question is formulated that refers to investors' expectations regarding the development of the yield curve for German government bonds. The investors are asked here whether they expect a flattening, a parallax shift or a steepening of the yield curve in the near future. The shares of the votes that are allotted to the different possibilities of the movement of the yield curve result in the three sub-indices of this indicator group, namely the sub-indices of the sentix Curve Barometer for a) flattening, b) parallel shift and c) steepening.

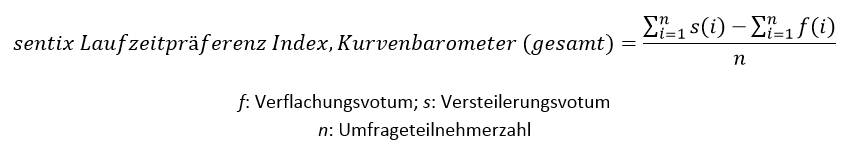

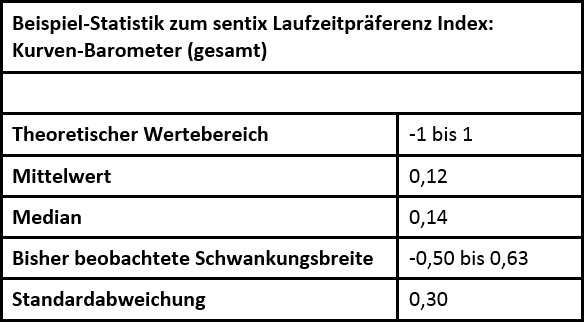

The so-called "headline" index, i.e. the sentix curve barometer (per se), is constructed as the difference between the sub-indices for steepening and flattening. It is therefore an index that reflects the net expectations for the steepening of the yield curve for German government bonds. It can be used as a forecasting instrument for the development of the yield difference between 10-year and 2-year Bunds (as an approximation for the steepness of the yield curve for Bunds) (cf. Figure 2).

Customer Feedback (0)