|

20 April 2015

Posted in

Special research

Sentiment for German equities has cooled down dramatically after the party the week before. Such a negative impulse is often followed by falling prices. But there is important reasons why a correction should not occur this time.

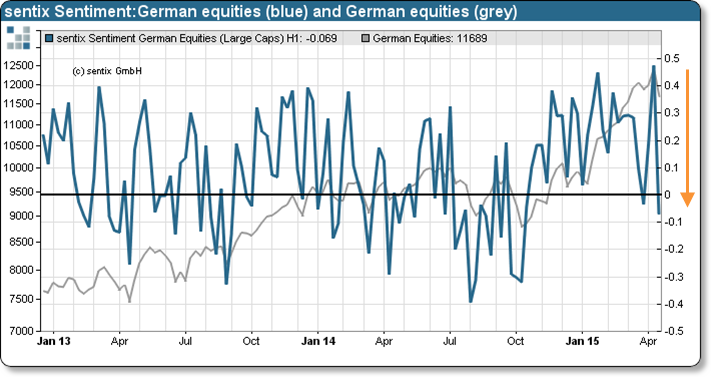

sentix Sentiment for German equities collapses in the latest sentix survey dating from last weekend. It falls from +0.47% to now -0.07% – and thus from its highest reading since the end of 2010 to a 26-week low (s. first graph). Usually such a strong fall in sentiment heralds weakness for the weeks ahead.

But at the same time sentix Strategic Bias for German stocks further increases which clearly distinguishes the current setting from previous sentiment setbacks. The basic conviction of investors for the asset class thus remains shatter-proof. And as long as investors’ strategic views do not show any feebleness the strong fall in sentiment should be regarded as a healthy development.

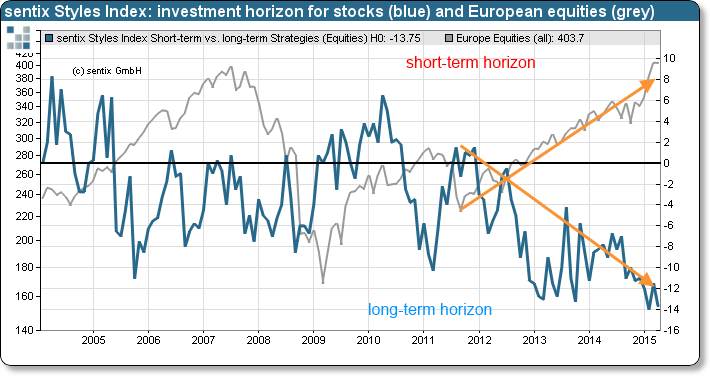

This is also underpinned by other sentix indicators: Ever more investors, for instance, buy stocks as long-term investments (see second graph) which should dampen the usual fickleness of the market. Furthermore, the preference for dividends stays on elevated levels in the current zero-yield environment. Consequently, the bull market’s leitmotiv has not changed. And the cold shower coming from the fall in sentiment now even serves as a much welcome cooling.

Background

sentix Sentiment, investors’ 1-month expectations for a given market, is polled on a weekly basis since 2001 as part of the sentix Global Investor Survey. It reflects the emotions – between greed and fear – of market participants. Negative sentiment extremes are usually a straight indication for rising prices. High optimism, in contrast, may be a warning signal for an upcoming market consolidation. More important turning points are mostly indicated by a sentiment divergence.

sentix Strategic Bias, investors‘ 6-month expectations, is also polled on a weekly basis since 2001 as part of the sentix Global Investor Survey. It reflects the strategic view of market participants as well as their basic convictions and percep-tions of value for a given market. As this indicator represents investors’ general willingness to buy or sell it should not be interpreted as a contrarian signal. Rather it is usually leading the market by several weeks. And as the indicator mainly stands for investors’ longer-term convictions it is an indicator coined by the “wisdom of crowds”, bundling the knowledge floating around in a market of heterogeneous players.

“sentix Styles Index: investment horizon for stocks” is polled since around every third Friday of a month as part of the sentix Global Investor Survey. The indicators’ history dates back until 2004. The index shows if equity investors operate with a rather short-term or a rather longer-term view. A longer-term view indicates stronger conviction and thus higher tolerance for losses. The indicator reflects investors’ medium-term expectations and thus often leads market developments.

The current sentix Sector Sentiment survey was conducted from April 16 to April 18, 2015. 987 individual and institutional investors took part in it.