|

12 December 2016

Posted in

Special research

sentix Sentiment for the German equity market scores new record high. Investors celebrate previous week’s stock market gains. The latest sentiment frenzy represents a short-term contrarian sell signal – a similar set-up as last year.

While investors remained cautious before the Italian referendum and the ECB meeting last Thursday, the winds have changed. The German stock market DAX jumps to a new annual high, thus leaving its five-month long trading range in the wake of the nonappearance of political surprises. The message of the ECB to pump more liquidity into financial markets reached its target audience. Investors are in party mood. The share of bullish market participants has risen 36% in a single week.

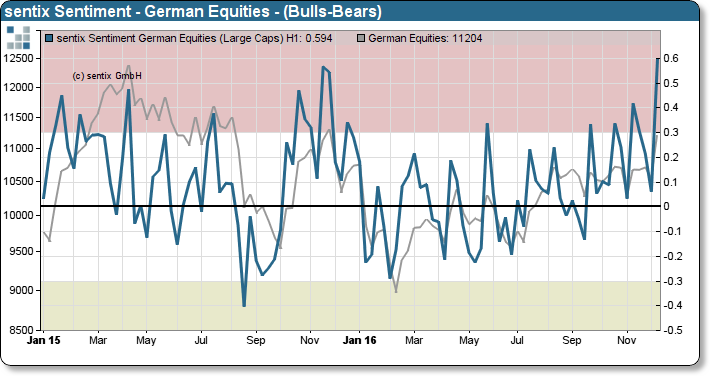

Hence, almost 67% of survey participants indicate that they are now “bullish” (optimistic) towards German equities. Only 8% of investors remain “bearish”. The presented index value of 0.59 (see chart) is the difference between “bullish” and “bearish” survey participants. Technically, an extremely positive sentiment reading is not only an indicator for an overstretched market but also a contrarian sell signal.

Our data shows that the market needs time to digest after the near-term optimism in the equity markets reaches extremely elevated levels. The market could follow a similar path to neutralise investors’ sentiment such as in November/December 2015. However, there is no guarantee that the market follows the same pattern as last year. However, in financial markets, it can be costly to believe “this time is different”.

Background

The sentix Sentiment indices, which capture investors’ 1-month expectations for a broad range of financial markets, are calculated on a weekly basis since 2001 as part of the sentix Global Investor Survey. The sentix sentiment reflects human emotions – between greed and fear – of market participants. Negative sentiment extremes are usually a straight indication for rising prices. High optimism, in contrast, may be a warning signal for an upcoming market consolidation. A sentiment divergence mostly indicates more important turning points.

The current sentix Sector Sentiment survey ran from 01-December to 03-December-2016 and 1.012 individual and institutional investors took part in it.