|

02 March 2015

Posted in

Special research

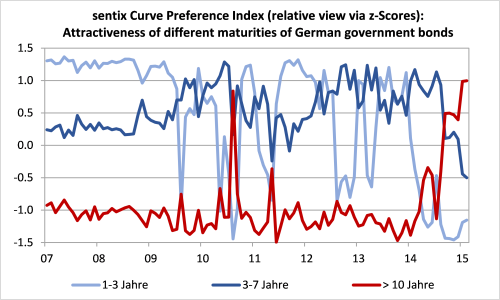

Record-low yields drive investors into ever longer maturities of German government bonds. This situation is mirrored by the sentix Curve Preference Index: While investors’ dislike of mid-term bonds has reached a new extreme, market participants now find bonds with maturities of more than 10 years as attractive as never before – although their yields have touched new all-time lows, too. This shows how desperate bond investors’ are in the current low-yield environment.

The sentix Curve Preference Indices – which were polled via the latest sentix Global Investor Survey – show a remarkable development: bond investors’ preferences for mid-term bonds (3 to 7 years) are on an all-time low since their inception in 2006 (see graph, dark blue line). At the same time, investors have never before found German government bonds with maturities of over 10 years more attractive than currently, at least in relative terms (see graph, red line).

This development is irritating as large parts of German government bonds with longer maturities already yield less than 1%. But it is the negative yields which have chased investors first out of short-term bonds (maturities between 1 and 3 years, see graph, light blue line) and now also out of bonds with maturities between 3 and 7 years (see graph, dark blue line). Consequently, long-term bonds are now relatively most attractive.

But the despair of bond investors is not only reflected by the high popularity of low-yielding long-term bonds. It is also stressed by rising economic expectations of market participants which usually lead to a steepening of the yield curve, making bonds with longer maturities rather unattractive. Consequently, many investors who now act according their current curve preferences could soon be caught on the wrong foot!

Background

The unique indicator family of the sentix Curve Preference Index comprises time series about investors’ expectations regarding the developments of different segments of the yield curve of German government bonds. They are primarily an additional tool for the better understanding of investors’ perceived bond market dynamics. Furthermore, they can be used as directional indicators for the German bond market. The indices are surveyed on a monthly basis, around the fourth Friday of each month since 2006 and published on the following Monday morning.

The current survey was conducted from February 26th to February 28st, 2015. 980 individual and institutional investors took part in it.