|

20 January 2014

Posted in

Special research

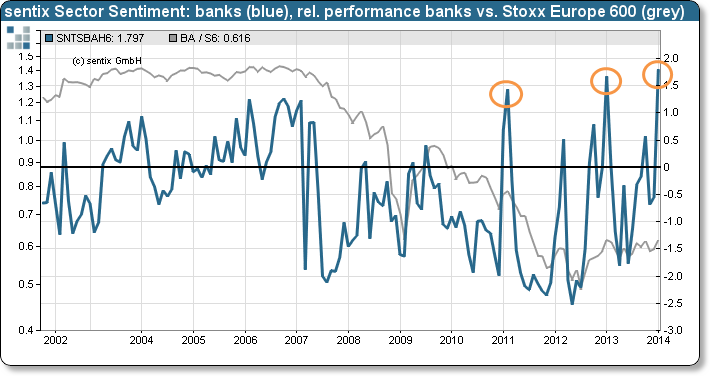

At the beginning of the year sentix Sector Sentiment for banks jumps to a new all-time high. Investors thus leave the euro crisis behind mentally – as banks were at the centre of the euro zone's problems since 2007. But for the future performance of banks stocks and the equity market as a whole this is rather bad news.

In January, sentix Sector Sentiment for banks rises strongly and reaches an all-time high at 1.80 (see graph). Consequently, investors are now extraordinarily confident concerning a coming outperformance of banks stocks. In addition, sentix Sector Sentiment climbs for the other two industries within the financial sector, namely for insurances and for financial services firms. At the same time, investors lose their love for crisis favourites like pharma, household goods, or telecoms.

For banking titles and the stock market as a whole this development is a warning signal. Usually, sentiment extremes are followed by performances in the opposite direction. After this month's all-time high for banks we are thus now likely to observe an underperformance of these titles in the coming weeks and months.

For the market as a whole it is two things that make us skeptical: the crisis' swan song which is mirrored in the sentix Sector Sentiment data, and the fact that the media has just recently turned to declare the euro crisis for over. But when the media and consequently the general public including the large majority of investors have already snapped up such a broad topic, it typically loses its power to push stock prices higher.

Background:

The current sentix Sector Sentiment survey was conducted from January 16 to January 18, 2013. 916 individual and institutional investors took part in it.

sentix Sector sentiment is a monthly survey which is conducted since 2001 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. A value of +1 for a sector means, for instance, that the expectations for the sector stand one standard deviation above the mean over all sectors.