|

13 March 2017

Posted in

Special research

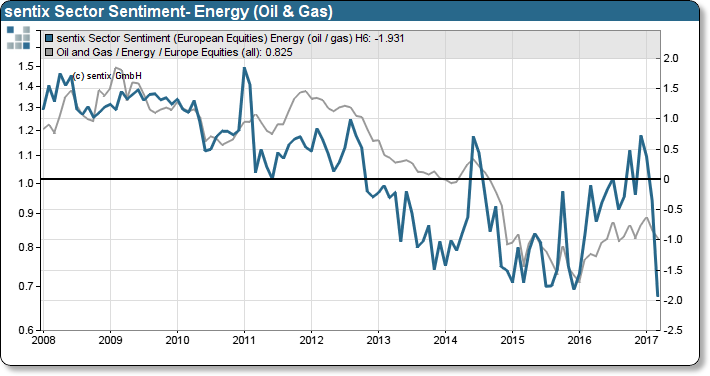

The sentix Sector Sentiment for European energy stocks has hit the lowest level since 2002. Within only a few weeks, investors’ perception has turned upside down. The latest shift in investors’ sentiment reflects the latest oil price shock. Energy stocks are not out of the woods yet due to an unfavourable oil market setup.

After last month’s rather optimistic sentiment towards the European energy sector, the situation in March has flipped upside down. Investors’ sentiment has plummeted to the lowest level ever recorded since 2002 (refer to chart). The close relationship between crude oil prices and European energy stocks has caused quite a stir with investors. Especially institutional investors downgrade their expectations, and for the first, in 12 months they even express a pessimistic sector outlook, on average. Nevertheless, comparable sentiment drops yield positive sector performance within the following months, as such shocks are most likely an overreaction (fear-driven). Due to its composition, the sentix Sector Sentiment does incorporate investors' valuation towards an industry but also a standard sentiment component. Contrarian theory teaches that extreme negative sentiment values ought to be interpreted positively.

Despite that, energy stocks are not out of the woods yet, as the oil market itself remains troubled. Both, the sentiment and investors’ valuation towards crude oil continue declining. At the same time, investors’ portfolios remain heavily “long” invested in crude oil futures. As long as this discrepancy remains unsolved, we do not expect strength in the European energy sector.

Background

sentix Sector Sentiment is a monthly survey conducted since 2002 among individual and institutional investors as part of the sentix Global Investor Survey which runs on the second Friday of each month. Investors are asked about their 6-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised and calculated as z-scores. Z-scores are standard deviations from the mean of a given sample. A value of +1 for an industry sentiment says, for instance, that the expectations for the industry stand one standard deviation above the average expectation for all sectors.The current sentix Sector Sentiment survey ran from 09-March to 11-March-2017, and 1.078 individual and institutional investors took part in it.