|

22 June 2015

Posted in

Special research

49.5% of investors currently expect a “Grexit” to happen within the next twelve months. This is shown by a new survey conducted by sentix over the weekend. At the same time the basic conviction for European stocks rises strongly. Consequently, investors anticipate a “happy end” of the Greek drama. A resumption of the bull market is thus near.

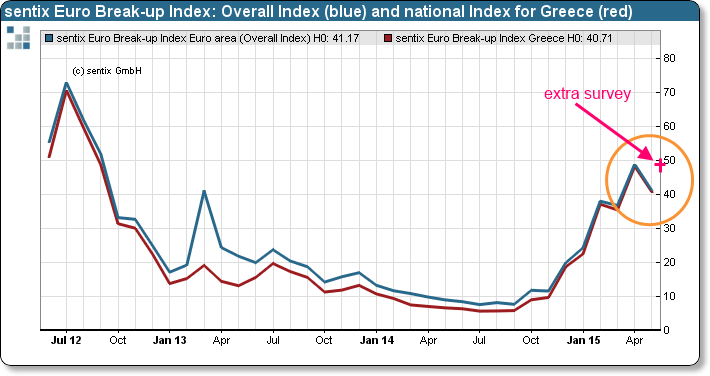

Outside our usual schedule we have asked via the latest sentix Global Investor Survey which share of investors expect Greece to leave the euro zone (“Grexit”) within the next twelve months. The result is 49.5%. At the end of May it was 40.7%, and in April 48.3% – when the index both times was polled via the regular survey on the sentix Euro Break-up Index (see graph).

Consequently, about the same portion of investors expect a “Grexit” as did at the end of April when the Greek topic also was hotly debated. But it surprises that, given the latest deadlock, the number of these market participants is not much higher. Investors obviously anticipate a “happy end” – of whatever kind – of the Greek drama. The assessment is under-scored by a strongly rising sentix Strategic Bias for European stocks, a measure for investors’ basic conviction for a market. This implies that there is a significant risk should things yet turn out badly. But more than this the observed robustness shows that investors are looking through the Hellenic problems. A bull market is thus again in preparation.

Background

Within the frame of the sentix Global Investor Survey we have – outside the regular schedule – asked investors about their opinion on the likelihood of a so-called “Grexit” within the next twelve months. The current reading of 49.5% indicates that exactly this share of investors expect it to happen within a years’ time.

Generally, sentix polls around every fourth Friday of a month the sentix Euro Break-up Index. This survey asks investors about their general expectations that a country – which could be any euro-member state – will leave the euro zone during the next twelve months. Within the survey investors also can pick single countries whose euro-exit they anticipate. Via this sub-poll the national sentix Euro Break-up Indices are calculated.

The sentix Strategic Bias (which is surveyed since the beginning of 2001) reflects investors’ 6-month expectations and thus their strategic view and basic conviction for a market. Because of this characteristic it serves as a directional indicator which usually leads the corresponding market’s development.

The latest sentix Global Investor Survey was conducted from June 18th to June 20th, 2015. 1020 individual and institutional investors took part in it.