|

18 May 2014

Posted in

Special research

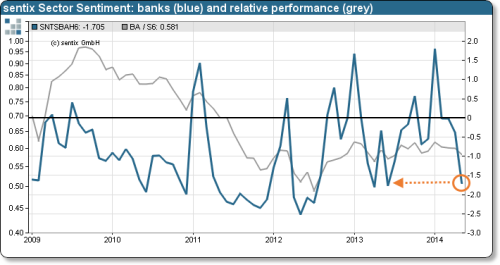

The euphoric mood for bank stocks observed at the beginning of the year has completely disappeared this month. In May, sentix Sector Sentiment falls for banks more strongly than for any other sector. Only for utilities investors are similarly pessimistic at the moment. The recent performance of bank shares does not explain such a weak sentiment, though. This is why there is now a chance for these stocks to recover.

sentix Sector Sentiment for European bank stocks falls by 1.31 to now -1.71 standard deviations (see "background" below for an explanation). This is the largest setback within all 19 sector sentiment indicators this month.

In January, sentiment for banks had stood at an all-time high for the sector. This euphoria has – with the massive drop in sentiment this month – now completely vanished. Problematic news related to important market players, stress tests ahead, and the discussion about negative rates for the European Central Bank's deposit facility have obviously left significant traces in investors' perceptions of the sector.

Meanwhile, the very recent performance of bank shares was only a little below average, and, over the last few months, it was more or less stable. So, performance cannot be the driving force behind the worsening sentiment. Rather it seems to be the current news flow which investors are over-reacting to. This is why there is now a chance for investors to rediscover the sector and, consequently, for prices to move up again.

Indicator background

The current sentix Sector Sentiment survey was conducted from May 15 to May 17, 2014. 939 individual and institutional investors took part in it.

sentix Sector sentiment is a monthly survey which is conducted since 2002 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. Z-Scores are standard deviations from the mean of a given sample. A value of +1 for a sector sentiment then means, for instance, that the expectations for the sector stand one standard deviation above the mean over all sectors.