|

13 February 2019

Posted in

Special research

Looking at the development of investor expectations towards the banking sector, one inevitably recalls the great financial crisis of 2008. Not only did share prices suffer almost as much in 2018 as they did then. The mood measured by sentix in sector sentiment is also similarly depressive. An interesting constellation for investors with opposing views.

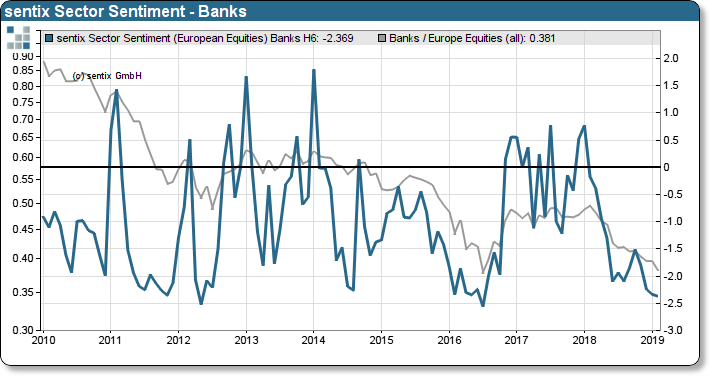

Since the financial crisis of 2007-2008, banks have been a crisis industry. Over the past eight years, the sector has been one of the stable underperformers. Opportunities for price increases were rare during this period. If they existed, however, they were reliably identified by sentix sentiment. The chart below shows the mood as a relative measure and normalized as z scores. A negative sentiment reading of more than 2 standard deviations is rare, but usually occurs in the final phase of pronounced periods of weakness. One such period of weakness was 2018, in which banks consistent-ly disappointed. The weak performance was accompanied by concerns about former industry giants such as Deutsche Bank and the Italian and French banks. Now, in February 2019, we again measure a very bearish sentiment of 2.36 standard deviations.

sentix sector sentiment banks vs. relative performance banks vs. STOXX 600

This is only the eighth time since 2001 that we have measured such negative investor expectations. In the last seven times, however, bank shares were on average able to increase by around 20% within a year. An interesting opportunity for contrary thinking investors!

Background

sentix Sector Sentiment is a monthly survey conducted since 2002 among individual and institutional investors as part of the sentix Global Investor Survey which runs on the second Friday of each month. Investors are asked about their 6-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform.

Around 1,000 private and institutional investors participated in the current survey on the sentix Sentiment sector, which was conducted between February 7th and February 9th, 2019.