|

18 August 2014

Posted in

Special research

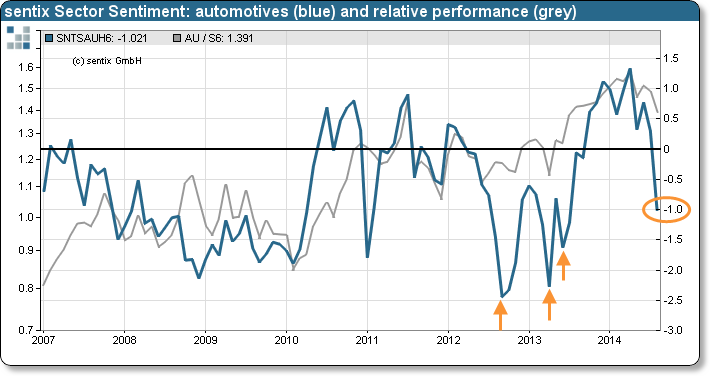

In August, sentix Sector Sentiment for European automobile stocks falls more strongly than for any other sector. Only a few months ago the same sector's sentiment had reached an all-time high. But falling economic expectations and a receding risk appetite now make investors more sceptical about the industry. Nevertheless, the data does not point to a contrarian opportunity yet.

sentix Sector Sentiment for European automobile stocks falls in August by 1.3 to now -1.0 standard deviations (see "Background"). Within the 19 Stoxx sectors this is the strongest decline. Just a few months ago, in April, the cheer for automobile stocks had hit an all-time high. Then, the positive sentiment extreme was already a warning signal. And since, investors' economic expectations – especially for Germany with its automotive heavy weights – have worsened visibly as shows, for instance, the latest development of the sentix economic index. In addition, sentix data also demonstrate that over the past weeks investors' risk appetite has receded. Both facts are a burden for the cyclical automotive stocks.

Although in negative territory now, sentix Sector Sentiment for automobile stocks does not reflect a contrarian opportunity so far as over the past years the indicator has on several occasions clearly hit lower levels. In 2012 it had even reached an all-time low of -2.4 standard deviations. Consequently, from a sentiment point of view the disenchantment of the sector after its spring high should not be finished yet.

Background

sentix Sector sentiment is a monthly survey which is conducted since 2002 among individual and institutional investors via the internet. The survey is run around the third Friday of each month. Investors are asked about their six-month expectations regarding 19 European stock sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. Z-Scores are standard deviations from the mean of a given sample. A value of +1 for a sector sentiment then means, for instance, that the expectations for the sector stand one standard deviation above the mean over all sectors.

The current sentix Sector Sentiment survey was conducted from August 14 to August 16, 2014. 916 individual and institutional investors took part in it.