|

17 March 2014

Posted in

Special research

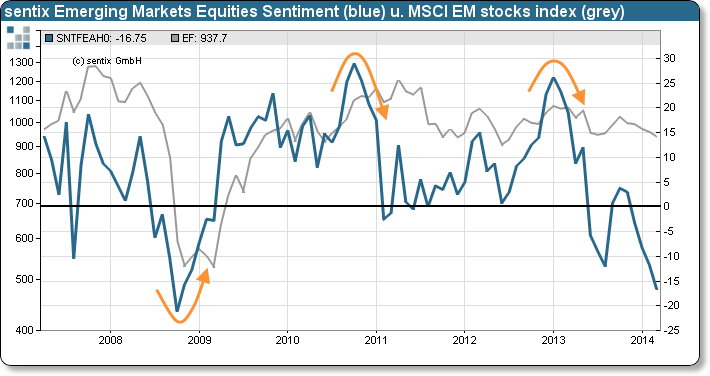

In March, sentix Emerging Markets Equity Sentiment falls markedly and now stands closely to its all-time low recorded just after the collapse of Lehman Brothers, an investment bank, in 2008. Contrarian investors may see this as an investment opportunity. But we remain cautious so far. Firstly, the indicator has a significant lead on the actual developments of emerging-markets stocks which means that there is no need to hurry at the current juncture. And secondly, investors might become even more pessimistic in the weeks ahead.

sentix Emerging Markets Equity Sentiment decreases from -11.75 to now -16.75 points this month (see attached graph). This is its fifth setback in a row and its second-lowest reading since its launch in April 2007. Only in October 2008, just after the collapse of Lehman Brothers, an investment bank, the index had looked worse (at -21.25 points).

Contrarian investors may read a buying opportunity for emerging-markets stocks into this extraordinarily low level of the index. But for two reasons we remain cautious so far.

Firstly, the index is usually leading the developments in emerging-markets stock indices. For instance, sentix Emerging Markets Equities Sentiment registered its all-time low in autumn 2008 while the emerging-markets stock indices did not turn round until spring 2009 (see attached graph). Consequently, before taking new positions in emerging-markets stocks one should rather wait until a trend reversal in the sentix index becomes evident.

Secondly, it seems that investors could well become even more pessimistic, leading to a further fall in sentix Emerging Markets Equities Sentiment. To our minds, there are still too many question marks behind the situation in the emerging markets which are not fully acknowledged by investors. The conflict in the Ukraine and the economic dynamics of China are only two examples.

As a result, we think that we are currently facing just the beginning of a bottom-building phase in emerging-markets stock markets.

Background:

sentix Emerging Markets Equity Sentiment is surveyed on a monthly basis since April 2007 and part of the sentix Asset Class Sentiment survey which is regularly conducted around the second Friday of each month. Further indicators of the sentix Asset Class Sentiment family of indices are sentix Bitcoins Sentiment, sentix Commodity Sentiment, sentix Credit Sentiment, sentix Emerging Markets Bonds Sentiment, sentix IPO Sentiment, and sentix Real Estate Sentiment.

Participants in the sentix surveys on asset class sentiment may choose a category from a range of 1 to 5 to show how inclined they are towards an asset class in relation to the others. The indicator may fluctuate between -100 and +100 while the third category (category number 3) of the given range marks the zero line and signals neutrality.

The current survey was conducted from March 13 to March 15, 2014. 927 investors (of which 230 institutional ones) took part in it.