|

08 July 2014

Posted in

Special research

The new sentix Market Profiles which shed a light on investors' expectations for the second half of the year 2014 show that forex market participants can easily be wounded at the current juncture. Expectations for EUR-USD have become extremely tilt to the downside. This represents an upside risk for the common currency! For stocks investors have longer-term a positive bias but in the short run there is potential for surprises on the upside, too.

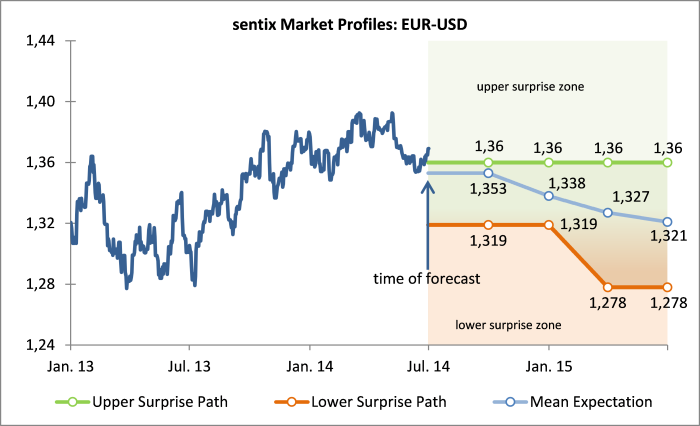

The latest sentix Market Profiles display one result that deserves utmost attention: 80% of inves-tors do not expect EUR-USD for the rest of the year – and beyond. This means that investors' expectations have become extremely one-sided for this market. And exactly this circumstance points to an upside risk for EUR-USD. The reason is that now many investors can easily be caught on the wrong foot. A clear increase to just over the current rate of 1.36 EUR-USD would relatively quickly lead to losses for many market players. That would then result in short coverings which in turn would serve as an acceleration in a – widely unexpected – euro strength. On average investors see EUR-USD at 1.338 towards year end. And also further down the road it is the euro pessimists that dominate (see attached graph).

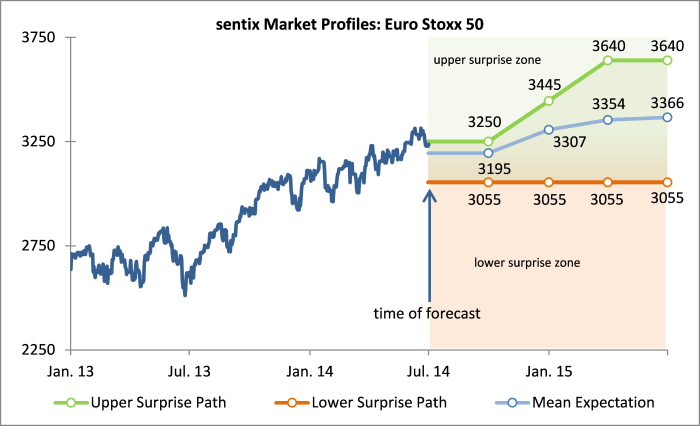

For European stocks the latest sentix Market Profils point to some surprise potential on the upper side, too. Here, most investors do not think that the Euro Stoxx 50 could rise over the traditionally difficult summer months. But longer-term stock investors still tend to have a bullish bias. That is what the sentix Market Profiles tell us for the end of 2014 and the quarters beyond. The – moder-ate – mean expectation of investors for the Euro Stoxx 50 for year end is 3307 points.

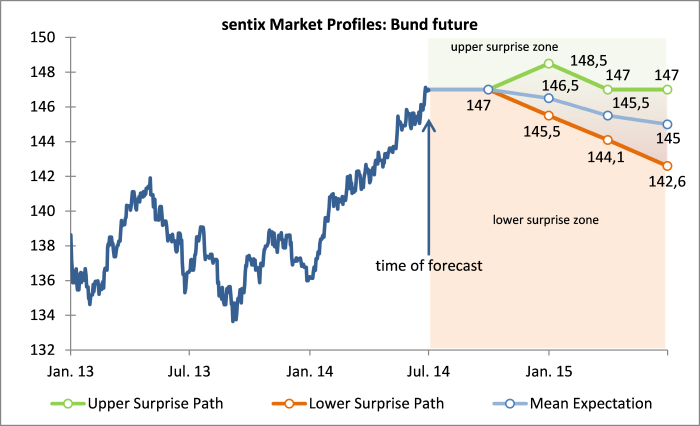

Investors barely understand what is currently happening with the Bund future. For the next three months a majority of 60% of investors do not expect any price change (surprise paths are identical) for this market! In addition, also until the end of 2014 and beyond investors expect only small fluctuations in the price of the security. We think that the volatility will be markedly higher in the months to come as we currently see a capitulation of the bears in the German bond market (see, for instance, our commentary on our weekly survey results dating from June 8 [in German]) making it a high risk environment.

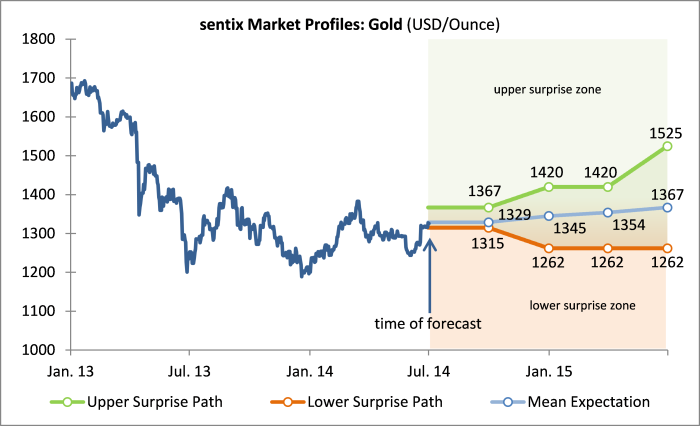

For Gold, on a three months horizon the narrowness of the expectations corridor is striking. Short-term, Investors should pay close attention to the price levels indicated by the lower and upper surprise paths. On the upside a break of 1367 USD/ounce could serve as a trigger for an acceleration in gold price increases. On the downside it is 1262 USD/ounce which investors should definitely care about. This latter price mark is not only the lower surprise path of the sentix Market Profiles for the quarters to come, it is also an important support from a chartist's point of view.

Annotation to the graphs

The "Upper Surprise Path" is the 80% quantile obtained from the sentix Market Profiles survey. It represents the exchange rate beyond which only 20% of investors think EUR-USD will rise. The "Lower Surprise Path" is the corresponding 20% quantile and represents the exchange rate below which only 20% of investors expect EUR-USD to fall.

Background

sentix Market Profiles are regularly surveyed at the end of each quarter. Here, investors are asked about their concrete, quantitative expectations for the Euro Stoxx 50, the Bund future, EUR-USD and the gold price – for time horizons of 3, 6, 9 and 12 months.

The current survey was conducted from June 26 to June 28. 903 individual and institutional investors took part in it.