|

27 April 2015

Posted in

sentix Euro Break-up Index News

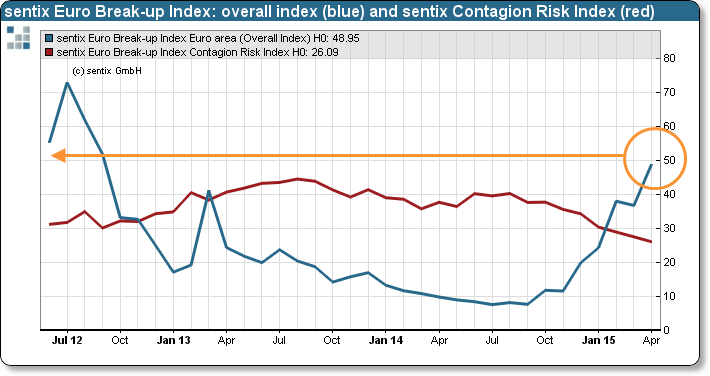

In April, the sentix Euro Break-up Index jumps to 49.0% from a previous 36.8%. Thus, European politicians’ promises to pursue the scenario of Greece keeping the euro are not taken at face value by about the half of all investors. In 2012 Mario Draghi calmed down investors with his ultimate commitment to the euro. But is his pledge still valid for Greece today?

The Euro Break-up Index (EBI) has currently reached about the same level as during the high times of the euro crisis in the year 2012 (see graph). And again it is Greece which pushes up the index. The Greek EBI climbs from 35.5% to 48.3%. Apart from that, it is only Cyprus that sticks out among the country indices. Its EBI increases slightly to just below 11%.

The national EBI for the remaining periphery countries – Italy, Spain, Portugal and Ireland – all display readings below 2% and thus indicate only negligible euro-exit risks. Consequently, the sentix Contagion Risk Index falls further: it now stands at 26.1%, a new all-time low (see again graph). Greece is thus currently perceived by investors as a very isolated case.

The Greek EBI shows that about half of all investors do not trust the politicians’ promise that there was only a “plan A” for Greece. The situation looks quite similar to the one in June 2012 when the EBI was surveyed for the first time. Then, Mario Draghi was forced to phrase his famous words concerning the irreversibility of the euro. Now, his measures are put to the test. Avoiding a “Grexit” would very likely call, once more, for Draghi.

Background

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Break-up Index can be found on: http://ebr.sentix.de.

This month’s reading of 49.0% means that currently this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012, and touched its low at 7.6% in July 2014.

The current poll was conducted from April 23 to April 25, 2015. 1023 individual and institutional investors participated.