|

25 August 2013

Posted in

sentix Euro Break-up Index News

In August, the sentix Euro Break-up Index (EBI) drops from 23.75% to 20.45%. This means that last month’s irritation concerning the Portuguese political crisis which also had affected the sentix EBI has now almost faded. At the same time, the German national Break-up Index rises slightly four weeks ahead of the general elections in the euro zone’s largest economy.

sentix conducts its EBI survey on a monthly basis in order to measure the probability investors attribute to the event of a euro break-up. The August EBI of 20.45% shows that currently about one in five investors thinks that at least one country will leave the euro within a year’s time.

Outstanding developments this month can be observed for Italy and Spain. In both cases the national EBI decline. The Italian EBI drops to 1.3% which is the second lowest reading since the inception of the sentix indicator in June 2012. The national EBI for Spain even falls to an all-time low of 0.8%. The two large periphery countries currently do not play any role anymore in investors’ perceptions regarding a euro break-up.

At the same time, the exit probabilities for the smaller countries Greece (17.4%), Cyprus (11.6%) and Portugal (4.3%) stay elevated, even if their current EBI also have receded. This means that the periphery remains divided: The two large economies of Italy and Spain are now opposed to the three smaller ones of Greece, Cyprus and Portugal, for which investors persist to see a relatively high exit probability – also because of the fact that the rescue packages for Greece and Portugal will expire next year. This polarization among exit candidates leads to an increase in the sentix Contagion Risk Index which now stands at about 45%. Consequently, those investors who expect a break-up to happen are more and more convinced that it will be more than one country leaving the common currency. And over the past three months their votes each time have concentrated on Greece, Cyprus and Portugal.

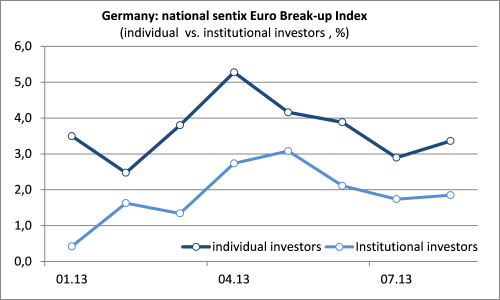

Four weeks before the general elections, a look on Germany is of special interest. In August, Germany’s national EBI has – against the general trend – slightly risen from 2.3% to 2.6%. And this is, despite its higher reading, once more bad news for the euro-critic party “Alternative für Deutschland” (“Alternative for Germany”), “AfD”. The reason for this is that there seems to exist a correlation between potential AfD-votes and those sentix survey votes indicating Germany’s exit from the euro. This thesis is underlined by the fact that AfD polls are fluctuating around 3% since April (when the party was founded) which is about the same values the German EBI has displayed over that period of time. That said, it has to be noted that the readings of the individual investors’ national EBI were always higher than those of institutional ones. But even the individual investors’ break-up index has only managed to jump over the “five percent hurdle” once, and that was in April of this year. Now, in August, it stands at only 3.4%.

Annotation: The current sentix Euro Break-up Index reading of 20.45% means that currently about one in five investors expects the euro to break-up within the next twelve months. The EBI had reached its highest reading in its 15-month history in July 2012, standing at 73%. Its lowest reading of 17.2% was registered in January 2013. The current August poll was conducted from August 22nd to August 24th, 2013. 905 individual and institutional investors took part in it.