|

02 March 2015

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index for February rises strongly from 24.3% to 38.0%. Despite the soluattion which was found last week for Greece ever more investors expect the Mediterranean country to leave the euro soon. Also, for Cyprus the exit probability increases markedly. And, in the background, the lately surprisingly firm confidence in Portugal and Spain is eroding, too.

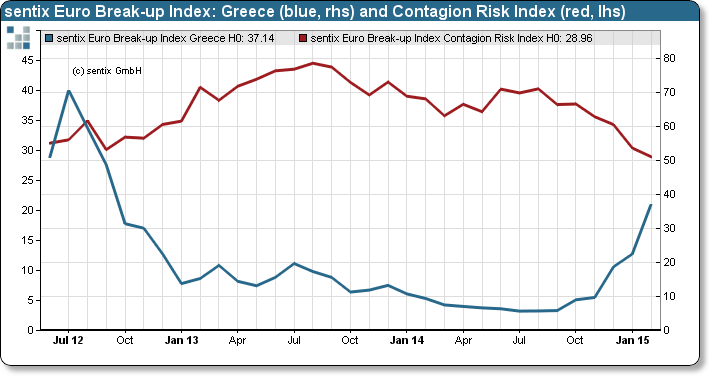

The sentix Euro Break-up Index (EBI) for February rises from 24.3% to 38.0%. This is its highest reading since March 2013 when elections in Italy and the unclear financial situation of Cyprus were irritating investors. This time the development is driven by a clearly worsening assessment of investors concerning Greece. The Greek national EBI climbs from 22.5% to 37.1%. Consequently, the new aid programme for the country does not seem to be convincing, rather is a “grexit” now bound to be a constant topic among investors for the months to come.

In the wake of Greece the EBI for Cyprus rises from von 6.4% auf 10.5% (highest reading since September 2013). Also noteworthy are the again increased EBI for Portugal (2.5%, highest since December 2013) and Spain (2.1%, highest since March 2013). In both countries general elections will be held towards the end of this year. These could result in Greece-like situations where anti-austerity forces might come to power. But this development is put into perspective by the sentix Contagion Risk Index falling slightly from 30.4% to 29.0% (see graph, red line). This shows that investors – despite their rising nervousness – still regard Greece as a rather isolated phenomenon.

However, the increase in Portugal’s EBI has at least one immediate effect: Over the past months we had often highlighted the relative attractiveness of Portuguese (10-year) government bonds, especially compared to Italian ones – as the Portuguese EBI was lower than the Italian one, while the yields for Portuguese bonds were still much higher. This constellation has changed clearly. The advantage of Portuguese bonds has now almost completely disappeared!

Background

The current sentix Euro Break-up Index reading of 38.0% means that currently this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012, and touched its low at 7.6% in July 2014. The current poll was conducted from February 26 to February 28, 2015. 980 individual and insti-tutional investors took part in it.

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. The corresponding poll is running for two days around the fourth Friday of each month. Its results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the cur-rency union within the next twelve months. Further details can be found on: http://ebr.sentix.de.