|

31 March 2014

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) decreases once more to a new all-time low of 10.9% in March after 11.7% in the previous month. This reading shows that currently only one in nine investors expects at least one country to leave the euro area within the next twelve months.

At the national level, an extraordinarily positive development can be observed for Portugal. The Portuguese EBI falls by exactly one percentage point to a mere 0.5% which is its lowest reading since the indicators' launch in June 2012. This level implies that almost no investor expects a euro exit within a years' time for the Southern European country anymore.

The rest of the so-called periphery countries – including Spain (1.3%) and Ireland (0.7%) – all display higher EBIs at the current juncture! Nevertheless, for Greece (7.5% after 9.4%) and Cyprus (4.8% after 5.3%) the EBIs also reach new all-time lows. The country with the third-highest EBI remains Italy, even if its index recedes to 1.9% from 2.3%. Obviously, the change in government here still does not fully reassure investors.

Against the backdrop of local elections bringing about a defeat of the governing party and good results for the Front National, a party from the extreme right, sorrows have increased for France. The French national EBI rises by 0.8 percentage points to 1.4%. This is the second-highest reading for France since the launch of the EBI. Still, the level of the indicator is not dangerously high. But the mere fact that it is increasing against the general trend of the month is no good news.

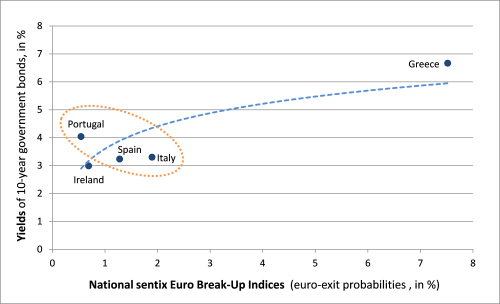

Turning to the implications for financial markets, the focus is again on Portugal. Over the past months we could already observe that Portuguese bonds were – taken the EBI as a yardstick – too cheap when compared with Spanish and Italian bonds. In other words, their yields have been too high. This is still the case for 10-year government bonds, for instance (see graph). But over the past few weeks the spread between Portuguese bonds on the one hand and Spanish and Italian ones on the other hand has actually fallen impressively. And on top of that, the current EBI numbers are telling us that this trend should continue!

About the sentix Euro Break-up Index

The current sentix Euro Break-up Index reading of 10.9% means that currently this percentage of all surveyed investors expects the euro to break up within the next twelve months. The EBI has reached its highest reading in its 22-month history at 73% in July 2012, and its lowest reading – before the publication of this month's survey results – at 11.7% in February. The current poll was conducted from March 27 to March 29, 2014. 946 individual and institutional investors took part in it.

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. The corresponding poll is running (parallel to the sentix Investor Positioning poll) for two days around the fourth Friday of each month. It is regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details can be found on: http://ebr.sentix.de.