|

28 November 2016

Posted in

sentix Euro Break-up Index News

The closer we approach the December 4th, the more does the Italian referendum occupy the minds of investors. Fears of more trouble in the Eurozone mount as Italy takes the spotlight in our monthly Euro Break-Index (EBI) survey. Surprisingly, Investors do not exclusively pick Italy as a potential exit candidate. Moreover, exit probabilities of many euro member countries are on the rise. Especially France and the Netherlands join ranks with Italy. The sentix EBI increases to 24.1%.

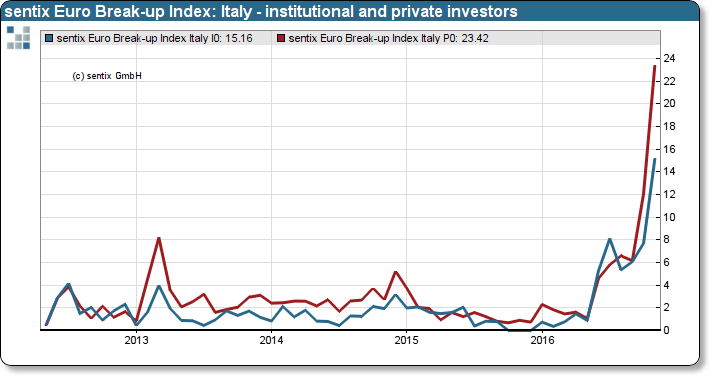

Investors are more and more worried about Italy. The perceived euro exit probability jumps to 19.3% which marks the highest level since the inception of the sentix EBI survey. Foremost, the massive decline of the Italian Target 2 balance (-345 billion Euro as of 30.09.2016) which hints toward capital flight, as well as the apparent weakness of the Italian Banking System (e.g. Unicredito and Generali), threaten the stability of the Eurozone. With the day of the constitutional referendum approaching, not only the political future of Premier Matteo Renzi is at stake – it is high time.

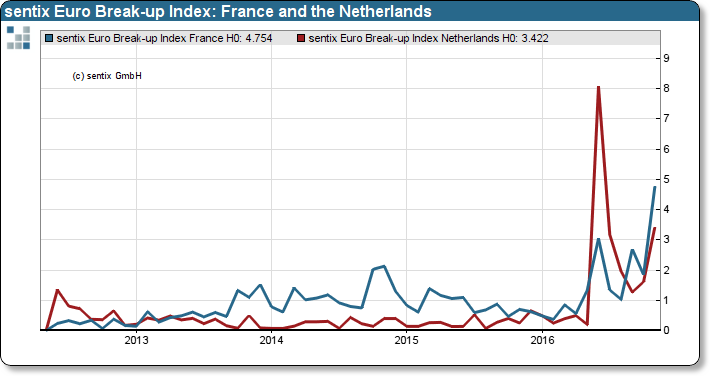

Typically only a single country occupies investors’ attention. This time is different. Unfortunately, we measure a significant increase in perceived exit probabilities across many member countries and, in particular for France. The French Index hits with 4.75% a new all-time-high. Even the Index for the Netherlands rises to 3.4% (refer to the chart below).

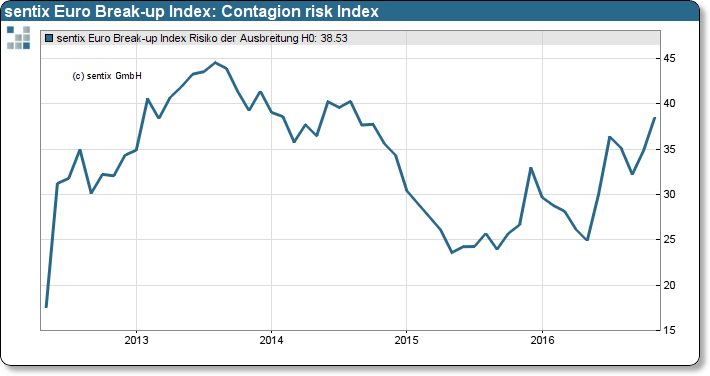

The overall rise to a likelihood of 24.1% that a euro member country quits the union in the next 12 months, reinforces the notion that a surprisingly strong anti-euro sentiment has evolved during 2016. Moreover, Brexit increased overall risk levels.

The sentix contagion risk Index mirrors this development, alike. The Contagion Risk Index exhibits strong momentum.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 24.1% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 7.6% in July 2014.

The current poll in which 1,036 institutional and retail investors participated was conducted from November, 24th to November, 26th 2016.