|

27 August 2019

Posted in

sentix Euro Break-up Index News

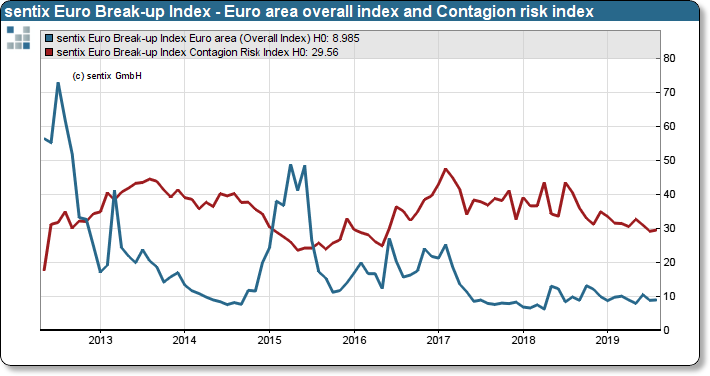

Despite the uncertainties about the development of the Euro zone economy and the approaching Brexit, investors are relatively unaffected in terms of Euro stability. The sentix Euro Break-up Index remains almost unchanged at 9.0 points. However, the index for the risk of contagion shows that a return of the Euro uncertainty is still not averted.

The fact that the sentix Euro Break-up Index, which reflects the risk of a break-up of the Euro zone from the point of view of the investors surveyed by sentix, is quoted almost unchanged in August is not a matter of course. The weak-ness of the global economy, which is increasingly having an impact on the Eurozone, and the approaching Brexit are developments that are currently moving investors strongly. But this does not affect the stability of the euro zone at the moment. The overall index remains virtually unchanged. The end of the government coalition in Italy does not scare investors either. The Italian sub-index rose only marginally from 6.7 to 7.1 index points.

sentix Euro Break-up Index: Headline Index Euro area and Contagion risk index

However, a look at the index of contagion risk shows that it is still latent and significantly higher than in 2015-2016, when "only" Greece was in question. So, it is no wonder that the ECB feels compelled to continue supporting the eu-rozone with monetary policy instruments. The crisis is currently asleep, but it is not completely over.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de

This month’s reading of 9.0% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.3% in April, 2018.

The current poll in which about 1.000 institutional and retail investors participated was conducted from August 22nd to August 24th, 2019.