|

29 September 2020

Posted in

sentix Euro Break-up Index News

While the year 2020 will be anything but quiet and uneventful, this will not affect the stability of the euro zone. On the contrary, the corona crisis is currently masking important differences and even promoting one or two steps towards unification.

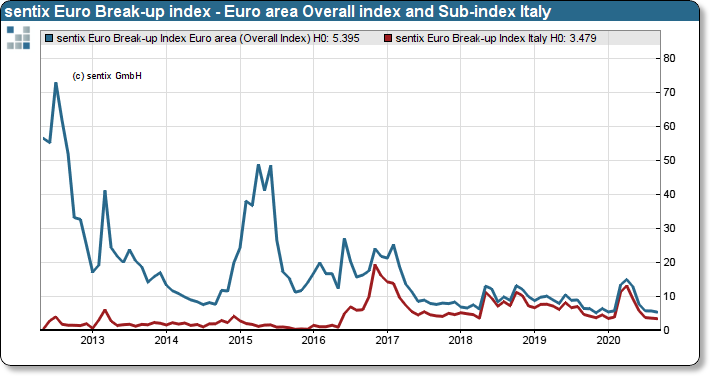

The sentix Euro Break-up Index remains at a very low level and at 5.4% at the end of September is only slightly above its all-time low, which was reached in November 2019. Investors therefore see only a small risk that the euro zone could break up. In the Corona crisis, the clocks are ticking differently and differences between the member states are currently being masked. The economic problems caused by the political measures to combat the pandemic are affect-ing all member states more or less in a similar way and are being contained by generous fiscal and monetary measures.

sentix Euro Break-up Index: Euroland Overall index and sub-index Italy

The largest political question mark from the point of view of the investors has not to do with the euro, but with the entire European Union, but it certainly concerns an exit. It concerns the “Brexit” negotiations, which are entering the home stretch and where no final solution is yet in sight. But even this is not an issue for the euro zone at the moment.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on https://ebi.sentix.de

This month’s reading of 5.4% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 5.205% in November, 2019.

The current poll in which more than 1.000 institutional and retail investors participated was conducted from Septem-ber 24th to September 26th, 2020.