|

27 January 2014

Posted in

sentix Euro Break-up Index News

After having climbed two months in a row the sentix Euro Break-up Index (EBI) falls to an all-time low of 13,3% in January. It stood at 17% in the previous month. With its current reading, the sentix EBI shows that less than one in seven investors expects at least one country to leave the euro area within the next twelve months.

There are two countries which prevent the EBI from even falling to one-digit territory for the first time since its launch: Greece and Cyprus. In January, It is only for these two that investors, individual and institutional ones, see a noteworthy probability for a euro exit within a year's time. But also for these two Mediterranean countries the national EBIs recede to all-time lows: for Greece the index now stands at 10.8% (after 13.3%), for Cyprus at 6.6% (after 10.0%). For the rest of the euro-zone members the national EBIs all stay below the 2%-line.

And there is even good news for the two "problem childs" of the last months, France and Italy. For France, President Hollande's recent reforms are obviously welcome by investors, especially by institutional ones. Among institutional investors, nobody sees France quitting the euro zone soon anymore. For Italy, the national EBI does not decrease in the same manner. But, at least, the misalignment of national EBIs and the yields of the corresponding government bonds of Italy on the one hand, and Spain and Portugal on the other hand, has become smaller. Italian bonds now seem to be priced in a fairer way than before when compared to Spanish and Portuguese titles by using the national EBIs as yardsticks.

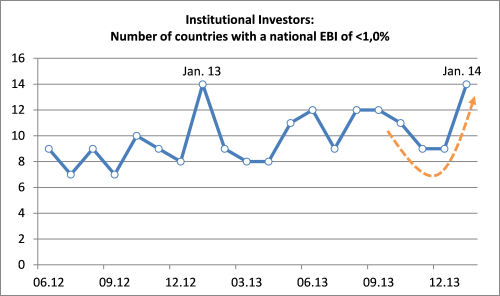

An exclusive look at the institutional investors' votes (by disregarding individual investors' ones) reveals that this group of survey participants remains relatively skeptical not only for Greece and Cyprus but also for Portugal. The Portuguese EBI of institutional investors still stands at 2.5%. More importantly, though, institutional investors do not expect any other euro country (than Greece, Cyprus and Portugal) to leave the currency union in the coming months anymore: For all these other euro members the national EBIs of institutional investors stand below 1% at the current junc-ture (see graph)!

Such a constellation was last observed exactly one year ago when – as now – investors got highly confident for the euro at the year's start. But this time the EBI has fallen to even lower levels. A euro break-up is thus more and more banned from investors' minds – at least for the moment.

About the sentix Euro Break-up Index

The current sentix Euro Break-up Index reading of 13.3% means that less than one in seven investors expects the euro to break-up within the next twelve months. The EBI has reached its highest reading in its 20-month history at 73% in July 2012, and its lowest reading – before the publication of this month's survey results – at 14.25% in October 2013. The current poll was conducted from January 23 to January 25, 2014. 974 individual and institutional investors took part in it.

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. The corresponding poll is running (parallel to the sentix Investor Positioning poll) for two days around the fourth Friday of each month. It is regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details can be found on: http://ebr.sentix.de.