|

28 October 2013

Posted in

sentix Euro Break-up Index News

In October, the sentix Euro Break-up Index (EBI) falls by 4.5 percentage points to a new all-time low since its launch in June 2012. It now stands at 14.25%. This month’s decrease is the third in a row. Only in January the index had reached a comparably low level at 17.15%. The sentix EBI indicates that it is now about one in seven investors who expects at least one country to leave the euro zone within a year's time.

The decrease of the sentix EBI takes place against the background of prevailing government negotiations in Germany which now head for a grand coalition. Furthermore, negative headlines concerning the euro zone were relatively rare over the past weeks. Rather it was the United States and their budgetary impasse which seized the attention of investors recently.

That the sentix EBI falls in October can – on a national level – once more chiefly be explained by investors' judgments concerning Greece. For Greece currently only 11.3% of all investors expect a euro exit within the next twelve months (after 15.6% in September). This is a new all-time low for the country. In addition, skepticism about Cyprus and Portugal fades. For Cyprus, the national EBI now displays a single-digit reading for the first time since January (8.7% after 11.0% last month). And the Portuguese EBI almost halves since September and comes down from 4.0% to now 2.1%.

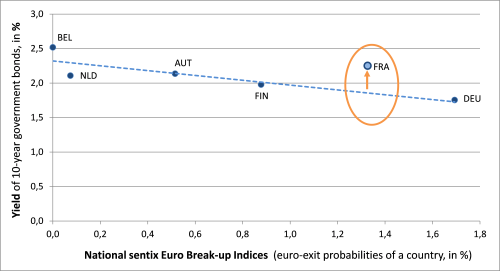

Among the so-called core countries the two euro-zone heavy weights, Germany and France, stick out: While the German EBI recedes further from 2.0% to 1.7%, the French index increases – against the general trend – from 0.5% to 1.3%. The development of the French EBI should be watched closely in the coming months, even if it still stands at a low level. But the surprising rise of France’s EBI in relatively calm times shows that investors’ perception is now shifting towards the problems of this big Western European country, problems which were there already for a long period of time. If one looks at the EBI-yield-combination of the other core countries, France does not quite fit into the general picture anymore (see graph): yields for its 10-year government bonds look by far too high if one takes the EBI as a yardstick. This could be interpreted as a mispricing of French bonds and thus a buying opportunity, but should the focus of investors shift more and more towards the various problems of the “grande nation” in the time to come, the country runs the risk of quitting the group of the core countries and its government bonds spread would certainly rise.

Annotation concerning the attached graph:

On the x-axis one finds the national sentix EBI values of the euro zone core countries which equal their euro-exit probabilities. On the y-axis the yields of the corresponding 10-year government bonds are displayed (as of October 25, 2013). It can be seen that a higher national EBI results in a lower yield investors demand for buying a core country bond. In other words, the safety premium investors are willing to pay for a government bond of a euro zone core country rises with the possibility of a euro-exit out of its own strength. This months’ graph shows that the French EBI-yield combination has clearly moved away from the trend line resulting from the other core countries’ data points.

Annotation concerning the sentix Euro Break-up Index: The current sentix Euro Break-up Index reading of 14.25% means that about one in seven investors expects the euro to break-up within the next twelve months. The EBI had reached its highest reading in its 17-month history at 73% in July 2012. Its lowest reading of 17.15% was – until this months’ survey – registered in January 2013. The current poll was conducted from October 25 to October 27, 2013. 906 individual and institutional investors took part in it.