|

29 April 2013

Posted in

sentix Euro Break-up Index News

The sentix Euro Breakup Index (EBI) for April falls from 41.1% to 24.4%. In the two previous months the EBI had increased as the outcome of the Italian elections and the Cypriot bail-out had rendered investors more pessimistic. As these two topics have become less scary in the meantime, investors have again become more confident concerning the future of the common currency: the current EBI value is the third lowest since the inception of the indicator in June 2012. Only in January and February the EBI stood lower.

A reading of 24.4% means that about one in four investors expects at least one country to leave the euro zone within the next twelve months. The EBI had reached a high in July 2012 with 73%. The current survey was conducted from April 25th to April 27th, 2013. 959 investors took part in the poll.

The strong decrease in the EBI was caused by the assessment of the Cypriot situation where the implementation of the rescue package has given investors a little more security now: Here, only 18.1% of the polled investors expect the island to leave the euro zone within a years’ time (previous month: 38.1%). Nevertheless, Cyprus remains the county with the highest national EBI. It is followed by Greece whose national EBI now stands at 14.2%.

While investors are less pessimistic in general this month, for the countries the national EBI have risen in April: for Germany (from 2.5% to 4.0%) and for Slovenia (from 1.6% to 2.6%). The German reading is the third highest among all national EBI, topped only by those for Cyprus and Greece. Apparently, investors were impressed by the tough stance of the German Bundesbank concerning the recent ECB measures – last Friday a document intended for the German institutional court was published by German newspaper Handelsblatt where these measures were heavily criticised. Also, the German elections campaign may have had an impact. So, the current EBI results may be a hint that during this campaign the euro might still cause some turbulences. This could hold true all the more, as individual investors – whose opinions better reflect those of voters – named Germany as a future euro-out twice as often as their institutional peers.

There is good news from other periphery countries in April: The national EBI for Spain and Portugal each recede slightly (to 2.1% and 2.4%, respectively). Against the background of the installation of the new government, the EBI for Italy drops even stronger from 6.0% to 2.7%.

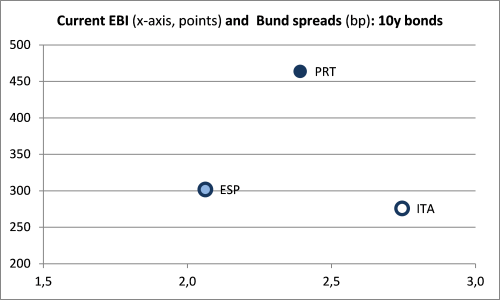

A look at the spreads for government bonds (over Bunds) reveals an interesting phenomenon: Although the national EBIs registered in April are relatively close to each other, there is a huge gap in the spreads for Portuguese bonds on the hand, and Italian and Spanish government bonds on the other hand (see graph). These cannot be explained by liquidity premiums only. The lower rating for Portuguese government bonds (below investment grade) is an additional obstacle to acquire those. Moreover, Italian bonds seem to be relative expensive to Spanish bonds, if you take their national EBIs as a benchmark.