|

27 May 2019

Posted in

sentix Euro Break-up Index News

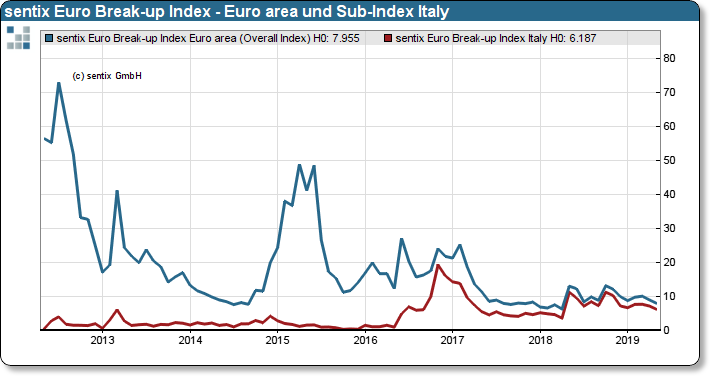

The current survey on the sentix Euro Break-up Index showed relaxed investors before the EU election. The overall index for the euro zone fells further to 7.96%. This is the lowest value since April 2018. The sub-index for Italy is also following this trend and is also falling by 1 percentage point.

Even though the elections to the EU Parliament were often regarded as a choice of fate, this event did not really move investors in the run-up to the elections. Since the beginning of the year, the sentix Euro Break-up Index has shown no major swings and immediately before last weekend's election even a further downward trend. The overall index is below 8%, its lowest level since April 2018, and the sub-index for Italy, the country that investors currently believe is most likely to leave the euro zone, is down to just 6.19%.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Even Theresa May's announcement to resign as the prime minister of the UK on 7 June 2019 did not make a measurable impression on investors when it came to euro stability. After all, around half of the investors surveyed did not vote until after the decision to withdraw. This suggests that investors are assuming that even a hard Brexit and budgetary policy in Italy currently favours measures to strengthen cohesion in the euro zone rather than split trends.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 7.96% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.3% in April, 2018.

The current poll in which about 1.000 institutional and retail investors participated was conducted from May 23rd to May 25th, 2019.