|

27 August 2018

Posted in

sentix Euro Break-up Index News

In recent weeks, investors' concerns about the stability of the euro zone have grown somewhat greater. The Italian government's attitude to the refugee crisis has contributed to this, as have increased concerns about an unregulated Brexit and Greece's "release" from the aid programme.

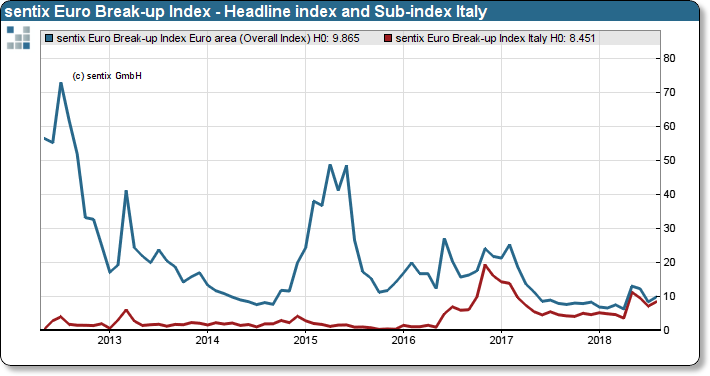

The sentix Euro Break-up Index rose by 1.2 points to 9.86 points in August. Investors are thus reflecting on several de-velopments which, in their view, increase the likelihood of new problems in the euro zone. First of all, there is the Brexit, where more and more signs point to an unregulated EU-Exit of the United Kingdom. We were able to report corresponding concerns in the sentix policy barometer last week. But the behaviour of the Italian government in the refugee crisis also gives investors cause for concern. Accordingly, the sub-index for Italy rose from 7.17 to 8.45 points. Italy's likelihood of leaving is thus still the highest of the euro countries in the sentix survey on the Euro Break-up Index.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Another event was the termination of the aid programme for Greece, which in the eyes of those responsible is now able to cover its capital requirements on the financial markets. However, the euro zone does not quite trust the Greeks and has provided a liquidity dowry. Nevertheless, investors are more sceptical about Greece. The index rises from 3.86 to 4.75 points.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 9,9% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.3% in April, 2018.

The current poll in which more than 1.000 institutional and retail investors participated was conducted from August 23rd to August 25th, 2018.