|

25 July 2022

Posted in

sentix Euro Break-up Index News

For a long time, the sentix Euro Break-up Index was quiet. This is now changing: With the current government crisis in Rome, the third-largest economy in the EU has come into investors' sights as a potential exit candidate. The sub-index for Italy is rising more sharply.

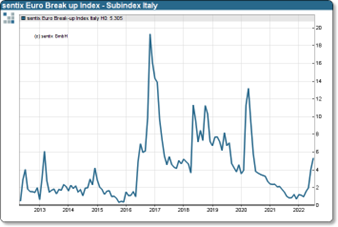

The resignation of Mario Draghi and the sharp spread widening of Italian govern-ment bonds at German bunds are increasingly pre-occupying investors. The sentix Euro Break-up Index for Italy signals unease. Although the increase is still relatively moderate in a historical context with a value of 5.3 points, the latest dynamics could indicate the beginning of a new trend.

sentix Euro Break-up Index - Subindex Italy

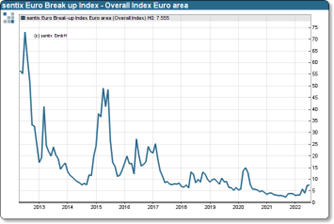

Is a new euro crisis looming? At +7.6 points, the overall index for the eurozone does not yet indicate any worry-ing development. We are a long way from the index highs of 2012 and 2015. Nevertheless, the rounding in the chart must be taken seriously. It would be prob-lematic if a series of EBI deteriorations were to occur in the coming months.

sentix Euro Break-up Index - Overall Euro area

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on https://ebi.sentix.de

This month’s reading of 7,6% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 2,3% in September, 2022.

The current poll in which more than 1.200 institutional and retail investors participated was conducted from November 21th to 23th July, 2022.