|

02 July 2019

Posted in

sentix Euro Break-up Index News

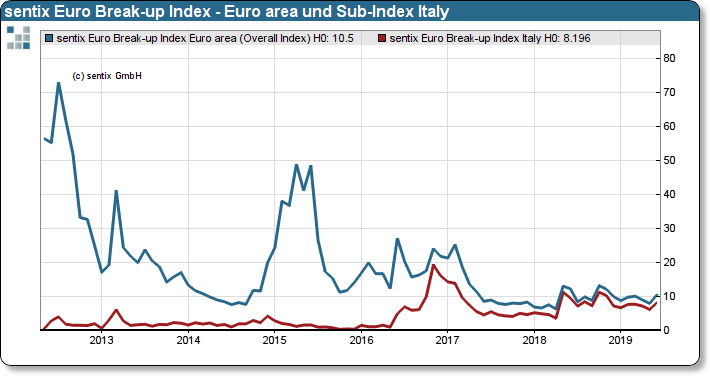

Uncertainty about the stability of the euro zone is on the rise again. This is entirely due to Italy and the Italian gov-ernment's policy not to adhere to the EU Commission's budget targets. The Italian sub-index rose to 8.2% from 6.2%, the highest level since November 2018.

The dispute between the EU Commission and the Italian government over Italy's budgetary policy is unsettling inves-tors. Even though the bond market seems to speak a different language at the moment, investors interviewed by sentix believe that Italy is more likely to withdraw from the euro. Although the current figure of 8.2% is not yet really a crisis indicator, it is not yet a reliable indicator. After all, the sub-index for Italy reached its highest level since Novem-ber 2018, with the Italian sub-index at its peak of 19.4% in November 2016.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

In the rest of the Eurozone, on the other hand, things have remained quiet so far. The Greek sub-index rose only in-significantly to 3.3% and is thus far below the value for Italy. The index for the risk of contagion also changes little. Nevertheless, the overall index for the euro area rose from 7.96% to 10.5%, in line with the indication for Italy. These figures do not yet include the recent discussion about the arrest of the German Seawatch captain. The survey under-lines that investors' nerves could quickly be overstretched again if the dispute between Italy and the EU intensifies again.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 10.5% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.3% in April, 2018.

The current poll in which about 1.000 institutional and retail investors participated was conducted from June 27th to June 29th, 2019.