|

26 February 2018

Posted in

sentix Euro Break-up Index News

The forthcoming parliamentary elections in Italy do not cause any discomfort among investors. At least investors do not see this as a threat to the stability of the euro zone. The sentix Euro Break-up Index falls again to an all-time low of only 6.6%! This represents a clear contrast to Renzi's December 2016 referendum vote, when investors were clearly shaking. But with the stable economy in the eurozone, however, stability has also returned to the euro question. But is the election event also becoming a non-event at the markets?

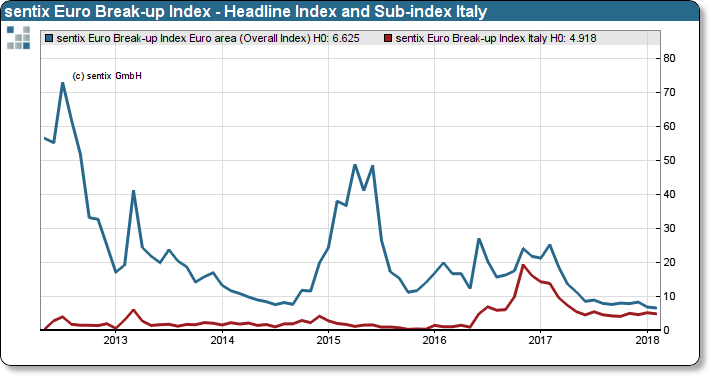

In the run-up to next weekend's parliamentary elections in Italy, investors are not very concerned about the continued existence of the single currency. The overall EBI index has fallen again by around 0.3% to an all-time low of only 6.6%. The Italian sub-index is also declining slightly. The stable economic situation in the euro zone over the last few months has also led to greater calmness on the euro issue. Other sub-indices are also yielding. The Greek index is now only 3.3%.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Does this mean that the upcoming events of the weekend (in addition to the parliamentary elections in Italy, investors are also looking at the decision of the SPD basis for a new Grand Coalition in Germany) will become a non-event? We investigated this question with the help of a special sentix survey.

Prior to major events, sentix may conduct special surveys to determine what investors' expectations are and whether investors have considered or intend to take into account the upcoming events in their portfolio trading.

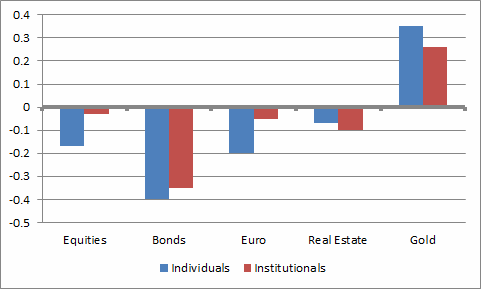

Expected market impact due to the Italian election on March 4th, 2018

Our special survey last weekend produced an interesting result. Most investors expect only minor effects from the upcoming elections. While private investors see a certain burden on equities, professionals do not expect any significant influence from the stock market. The effects on the euro are similar. The situation is different with the bonds. Both investor groups expect a significant burden here. Investors are bullish for gold. The results of the survey indicate that investors are therefore expecting a rather positive election outcome, a sustained good economy with increasing inflationary risks. This is largely in line with the prevailing opinion of recent weeks.

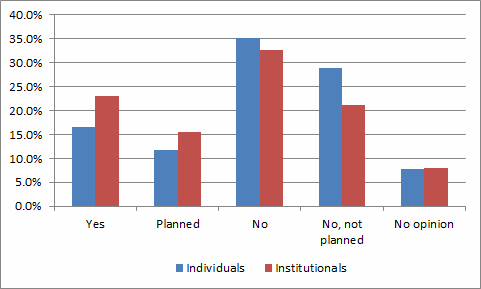

It is interesting to note that investors feel relatively little inclination or need to adapt to this scenario. This is likely to be since the scenario is in line with the prevailing picture of the past few weeks and that the portfolios already take this into account.

Status of implementation: Were the portfolios adjusted due to the Italian election?

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 6.625% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.625% in February, 2018.

The current poll in which about 1.000 institutional and retail investors participated was conducted from February 22nd to February 24th, 2018.