|

02 March 2021

Posted in

sentix Euro Break-up Index News

The situation in the Eurozone remains stable and calm. The entry into a European fiscal union, as Federal Finance Minister Scholz formulated it last week in the Bundestag on the occasion of the deliberations on the planned debt issuance by the EU Commission, probably also contributed to this.

According to Federal Finance Minister Scholz, the entry into a common debt via the EU Commission is a decisive step towards a European fiscal union. The interconnections under liability law in the Eurozone are becoming ever deeper and more complex. In addition, the way is being paved for taxes at the EU level. All this strengthens the perception of the Eurozone as a liability union and therefore even a government crisis in Italy cannot make investors nervous. However, it must also be stressed that in the person of the new president Mario Draghi, former head of the ECB, the per-fect solution to the government crisis has been found from the markets' point of view. Hopes that "Super Mario" will succeed in getting the long overdue structural reforms underway in Italia are in any case high.

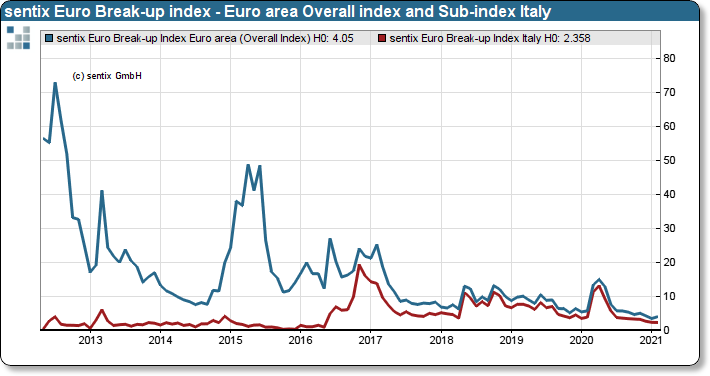

sentix Euro Break-up Index: Euroland Overall index and sub-index Italy

Among the countries with a high probability of exit, Italy remains the front-runner with a value of 2.4%. However, the absolute value is by no means worrying.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on https://ebi.sentix.de

This month’s reading of 4.0% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 3.5% in January, 2021.

The current poll in which more than 1.000 institutional and retail investors participated was conducted from February 25th to February 27th, 2021.