|

30 November 2015

Posted in

sentix Euro Break-up Index News

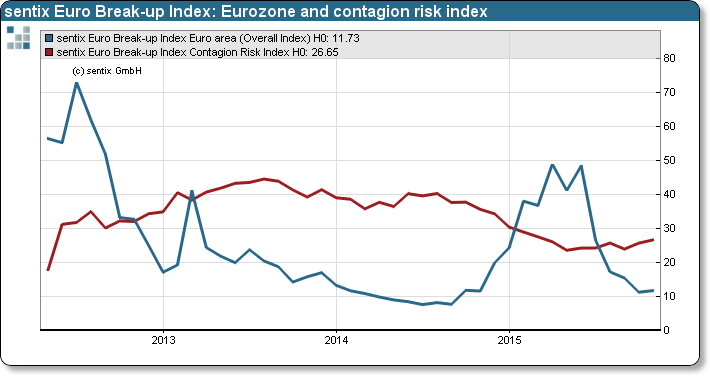

The sentix Euro Break-up Index (EBI) increases slightly in November. Following months of significant easing, the latest survey shows that 11.7% of respondents consider a break-up of the Eurozone within the next six months as likely. The list of mentioned “exit” candidates reaches an alarming level. Prospects of a possible Finnish referendum brings a “Fixit” into play.

After this summer’s successful “Grexit” prevention, for the time being though, things calmed around the euro crisis issue. Threats of terrorist attacks and fears of a hard landing of the Chinese economy drew investors’ attention away from crisis looming Eurozone. According to a classical drama, a solution to the euro crisis in the late stage of its fifth year should be in sight. News about a possible referendum in Finland, whether to stay in the euro or not, as well as consequences of a “Brexit” have caused uncertainty among investors. The latest sentix Euro Break-up index increases in comparison to previous month (refer to chart). Moreover, the risk of contagion within the Eurozone has steadily spread since mid-2015.

Generally speaking, investors have been sensibilised to an increasing number of potential euro and EU exit candidates. Worrying developments in Portugal, Spain, Italy and Cyprus could add up to potential surprises in the month to come. The ECB alone cannot solve issues in the long run. Therefore, sufficient potential compounded that in 2016 we may witness a comeback of the euro crisis. Hence, the classical drama has to go for extra time.

Background

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Break-up Index can be found on: http://ebr.sentix.de.

This month’s reading of 11.7% means that currently this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012, and touched its low at 7.6% in July 2014.

The current poll in which 1.033 individual and institutional investors participated was conducted from November 26 to November 28, 2015.