|

31 March 2020

Posted in

sentix Euro Break-up Index News

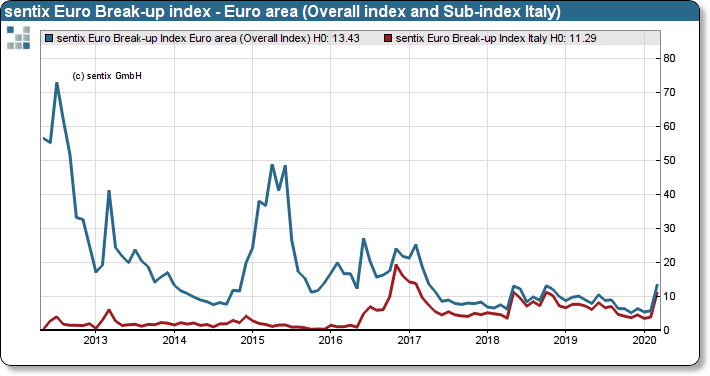

The corona crisis has worsened in recent weeks and, in addition to the health challenges, has also had a massive impact on the economy. Italy and Spain, two countries in southern Europe, have been particularly hard hit. There, the budget situation is likely to deteriorate sharply, which will increase the supply of government bonds. Investors are critical of this in view of the stability of the euro. The Euro Break-up Index rises to 13.4%!

At the end of February, investors were still relaxed and did not yet see the corona pandemic as a critical development for the stability of the euro zone. However, within four weeks it became clear that Italy and Spain, two countries in southern Europe, were particularly hard hit by the crisis. In both countries, the economy has now come to an almost complete standstill. As if the challenge for the health sector was not already great enough, existential economic threats are now being added to the list. Of course, this applies not only to these two countries, but to Europe as a whole. The obvious consequence is likely to be a significant increase in national debt in all euro countries. Investors are now worried that financing could become such a major challenge, especially for Italy and Spain, thus jeopardising euro stability.

sentix Euro Break-up Index: Euro area Overall index and sub-index Italy

In addition to the sub-index for Italy, which has risen to 11.3 points and thus the highest level since 02/2017, the sub-index for Spain has also risen significantly to 3.4% (highest value since 06/2016).

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on https://ebi.sentix.de

This month’s reading of 13.43% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 5.205% in November, 2019.

The current poll in which about 1.000 institutional and retail investors participated was conducted from March 26th to March 28th, 2020.