|

22 September 2014

Posted in

Special research

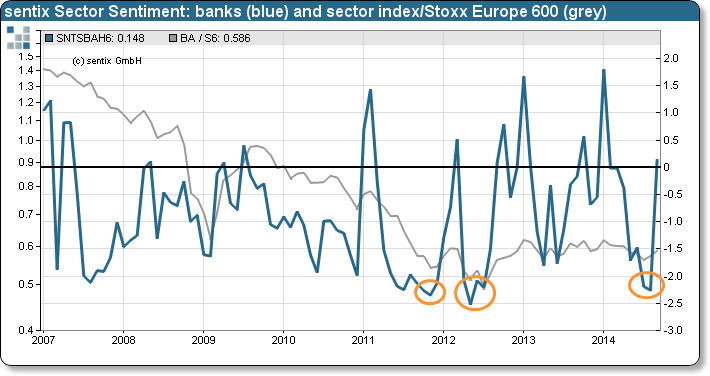

In September, a very strong increase can be observed for the sentix Sector Sentiment for European bank stocks. This comes after a negative extreme in the previous months. Investors are now celebrating the new ABS-buying programme of the European Central Bank (ECB). But as the enthusiasm has by far not reached all market participants yet, bank stocks should continue to benefit from this turn in investors' perception over the weeks to come.

sentix Sector Sentiment for European bank stocks jumps in the current month by over 2.3 to now 0.15 standard deviations (see "Background"). This is by far the most outstanding change in sentiment for all 19 Stoxx sectors surveyed. Investors thus celebrate the recently announced definite start of the ECB's ABS-buying programme.

Still last month the sentiment for banks had stood at a similar low level as in mid-2012 when it had marked an all-time low. Then, too, it was the ECB's president Mario Draghi who had managed to revive the mood for bank stocks via his euro commitment. Such a turn in investors' sentiment he had achieved to bring about even before, when at the beginning of his term in 2011 he had introduced the now famous LTROs. And this time it is the ABS-buying programme which has provided investors with new fantasies for bank stocks.

However, these sentiment improvements had never been long-lived so far. In contrast, sentix Sector Sentiment for banks has been moving like a yo-yo since 2011 as it often jumped from one extreme to the other within relatively short periods of time. But currently, the sentiment indicator has reached only average levels yet – meaning that not all investors already share the joy. Consequently, renewed enthusiasm for bank stocks will continue to be a feature of the weeks to come.