|

02 January 2017

Posted in

Special research

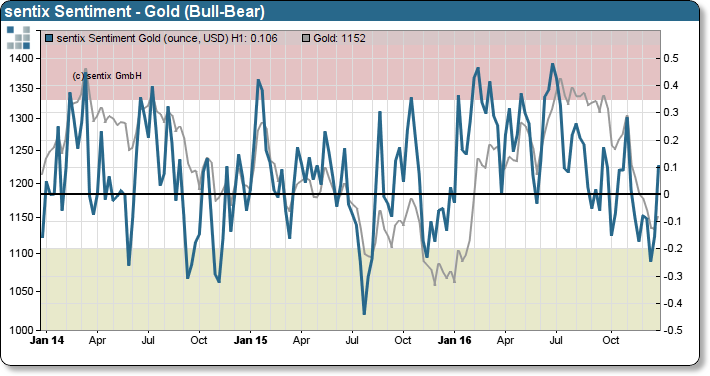

Technically, strong sentiment surges limit the upside potential of markets. Based on our statistics investors can expect a merely 1.5% increase over the next four to 16 weeks, on average. We currently do net yet reckon with a durable turnaround. Investors still show only comparably low levels of conviction in gold. Also, based on positioning data provided by the CFTC, investors’ portfolio rebalancing still lags investors’ market view.

Hence, we expect that it is going to take some time until market participants witness a new gold bull market.