|

12 October 2015

Posted in

Special research

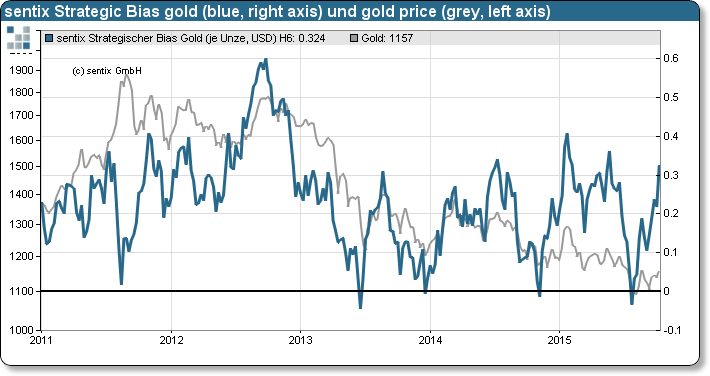

The latest sentix data reveals that investors rediscover gold as an attractive investment. The sentix Strategic Bias depicts an eleven weeks running upwards trend. The odds for precious metals, especially for gold, to remain bullish in the next weeks are favourable.

The current readings for the sentix Strategic Bias for Gold (the indicator captures investors’ six month expectations for gold) continues its strong upwards movement. The sentix strategic Bias for Gold commenced a rapid recovery movement, after heavily plummeting at the beginning of July’s sell-off (refer to Chart below). This indicator shows its frontrunning attribute at pivotal points, as demonstrated at the end of 2013 and 2014, through the fact that investors have to shift their fundamental opinions first. Subsequently, gold orders are placed therefore putting upward pressure on gold prices. Hence, an improving sentix Strategic Bias implies positive price signals.

The positions of „smart money“ (large speculators) as measured by the Commitment of Traders (CoT) data, as presented by the CFTC, confirms that investors indeed are starting to purchase gold. Such newly awaken interest in the commodity gold is consistent with the seasonal pattern for November/December. Therefore, we belief if gold significantly breaks the technically important 1170 USD/oz. resistance area, gold is a solid investment opportunity.