|

19 May 2016

Posted in

Special research

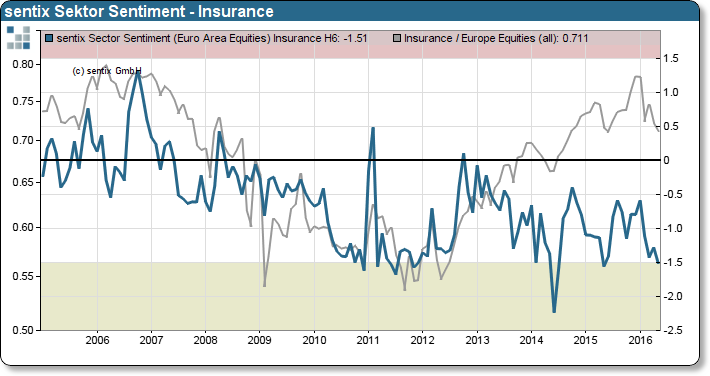

Negative stock price developments of European insurance companies cause frustration among the investment community. The sentix Sector Sentiment for European insurance stocks falls to a 12-month low in May. A potential buy opportunity could emerge.

The sentix sector sentiment for European insurance stocks has fallen back to a historically low level at -1.5 index points after recovering only temporarily. The current sentiment slump is in contrast to previous years not caused by a collective aversion of the banking and finance industry. Essentially investors respond with invigorated pessimism to negative stock price developments of the insurance industry.

The sentix Sector Sentiment measures which industry sector is en-vogue or is going to be shunned by investors within the next six months. In principle, negative indicator values lead to a weakening in the sectors performance. Extreme values, however, indicate a market move into the opposite. Investors willing to dump their holdings usually have done so, as values reach extreme territory. Hence, downward pressure on prices eases.

The latest development of the sentix Sector Sentiment confirms that the majority of investors have turned their back on insurance stocks (see chart). Based on a behavioural finance point of view, a potential buying opportunity could emerge if the sentiment continues to deteriorate.