|

04 July 2017

Posted in

Special research

After investors have shown comparatively unemotional results in recent months, this has changed in the recent sentix investor survey. Sentiment on German equities has suffered a dignified downturn and has fallen to its lowest level since February 2016. The uncertainty about whether and how a return of the expansive monetary policy is going to have been the trigger. However, this scepticism is rather favourable for the stock market perspectives.

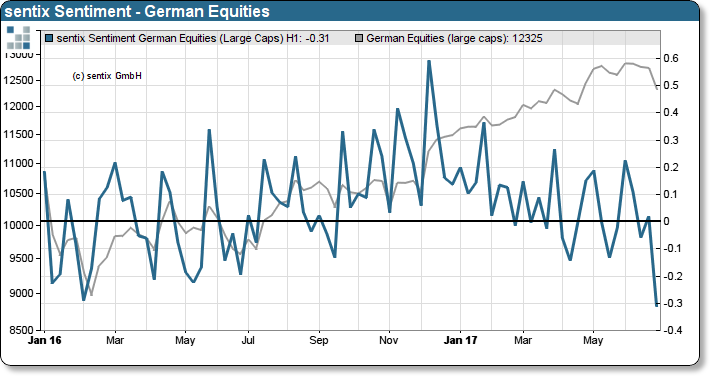

The correction on the German stock market in the last week of 3.2% has fueled the investor's emotions for the first time in a long time. The sentix sentiment barometer for the German stock market is clear and reaches its lowest level in more than one year at -0.31 (on a scale of -1 to +1). At the same time, the sentix investors asked to have further reduced their risk level in the portfolio.

sentix Sentiment – German Equities

Investors thus react to ECB comments which indicate that the future monetary policy will be less expansive than before. As the sentix thematic barometer has already shown in recent months, this is not a surprising development for investors. However, the memory of the price corrections of 2013, when the FED changed its monetary course, has a disturbing effect on the investors.

From the point of view of sentiment analysis, the current sentiment development must be assessed positively. On average, German equities gained 4.9% for a hit rate (number of paths with a positive result) of 83%. On average, the 16% increase was 8.3% with a 75% positive result.

The downside of this sentiment constellation, which is, in principle, interesting is that, due to the rapid break-in of the sentiment, which is like a negative sentiment impulse, it is not immediately possible to calculate fast price gains. Rather, the statistical studies show that it takes an average of two more weeks until the basis for a recovery is laid. Investors who want to use the current low sentiment also need patience.