|

15 December 2014

Posted in

Special research

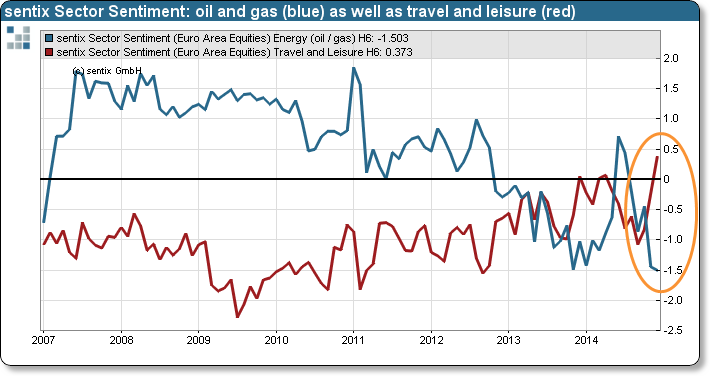

The strong fall in oil prices leaves its traces in the sentix Sector Sentiment. On the one hand, the sentiment for European oil and gas stocks drops to an all-time low. The same holds true for basic resources shares. On the other hand, some also benefit from the cheaper "black gold". "Travel and Leisure" as well as "Consumer Goods" are among those for which investors' perspectives brighten.

In December, remarkable developments can be observed in sentix Sector Sentiment: indices for several sectors reach extremes at the same time. We note all-time lows in sentiment for European oil and gas stocks as well as for basic resources shares. Furthermore, the indices for the travel and leisure sector and for consumer goods stocks climb to all-time highs!

Behind these developments should mainly be the continued fall in oil prices. And one man's poison is another man's meat: While the energy and basic resources industries suffer from lower raw materials prices, consumers' purchasing power increases and many companies input costs soften. This is why investors' sentiment improves so visibly for such sectors as travel and leisure or consumer goods.

Usually sentiment extremes, especially negative ones, are contrarian signals. Does this mean that the oil and gas or the basic resources sectors have now their worst behind them? Not necessarily. What is still missing is a signal for a trend reversal in the charts. One should wait for this to occur as catching a falling knife can be very painful.