|

14 November 2016

Posted in

Special research

Investors celebrate the surprising outcome of the US election. Investors’ sentiment for the US equity market has reached the highest level since 2010. In the past, comparable sentiment levels indicated that the US market is temporarily overbought.

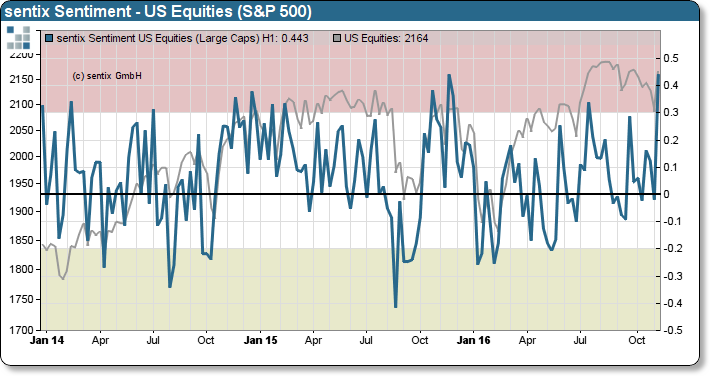

As pollsters, politicians and the media are still trying to regain countenance after being choked up by Trump's stunning presidential victory; investors rush to buy stocks. The S&P 500 stock index rose more than 1.8%. At the same time, the sentix Sentiment for US equities (S&P 500) climbs from previously -0.02 points to +0.44 points. This week’s sentiment reading is the highest value since 2010 and one of the strongest one week surges ever recorded (refer to chart). Expectations on large-scale fiscal stimulus packages and tax cuts for businesses inspire investors to dream of rising stock prices and a prolonging of the since 2009 existing bull market.

Rising share prices are indeed possible over the long run, as investors strategic confidence in owning US shares keeps up with rising sentiment values. Moreover, bulls can bank on more investors joining the party as undecided (e.g. neutral) investors are still plentiful available. Although there may be numerous reasons for a bullish trend continuation, due to current sentiment extreme, the market may take a break before ascending to new all-time highs. In the past, comparable levels of optimism lead to a consolidation within two weeks after the signal.

Consequently, we expect that the US market must digest the current sentiment extreme first, before advancing to new highs.