|

23 May 2018

Posted in

Special research

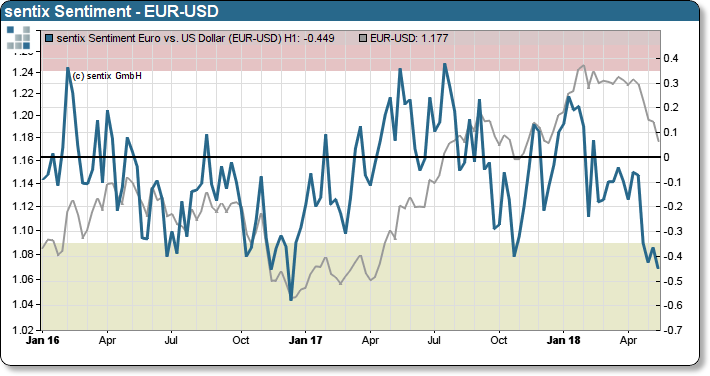

The US dollar has made a respectable comeback in the last four weeks. Against the euro, the greenback appreciated by around 6 cents and also strengthened against the Japanese yen. This has significantly changed the mood, as measured by the sentix sentiment. In the short term, investors are not as bullish for the dollar as they have been since the end of 2016.

The sentiment for the US dollar has fallen to its lowest level since the end of 2016. With a value of -44% the bears clearly outweigh the bulls in the sentix survey. This makes a countermove more likely after the sharp EUR-USD losses in the last four weeks. If the mood is so one-sidedly negative, in the past there have often only been short-term counter-reactions in the price.

sentix Sentiment – EUR-USD

Nevertheless, a general turnaround pro Euro is not to be expected. While there has been a significant shift in sentiment, the same is by no means true of investor positioning. This is signaled by the data on the US futures exchanges. Investors are losing twice as much on their still high Euro long positions: on the one hand due to the EUR-USD correction, and on the other hand due to the relatively high hedging costs resulting from the high interest rate differential between the USA and the Euro zone. We therefore believe that the strategic price target is 1.14/1.15 rather than 1.17.