|

22 February 2016

Posted in

Special research

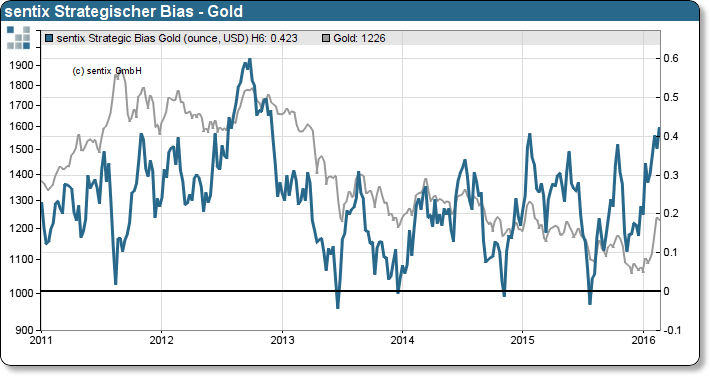

sentix Strategic Bias for Gold at 3-year high; fundamental attitude towards gold among investors at highest level since 2012. Despite Gold’s 13% surge, upward potential not exhausted.

The sentix Strategic Bias for Gold hits at .42 index points the highest reading since 36 months (see Chart below). The sentix Strategic Bias for Gold measures, due to its composition, investors’ expectations at what price level gold stands in six months’ time. Therefore, the indicator reflects the fundamental attitude of investors towards gold. Moreover, our time series reveals that when the sentix Strategic Bias has experienced a similar development in the past, gold prices have increased on average 5% in the following 16 months.

In addition to gold’s 13% increase, our price projection looks rather ambitious. Under consideration of positioning data, though, it looks quite realistic. The latest developments in gold prices are not as strongly reflected in the FTSE commitment of traders positioning data as it were the case in 2014/15. Potential exists that investors will translate their positive attitude into further gold purchases. According to our analysis, the latest recovery behaves fundamentally different from short-term recovery cycles of the previous three years.