|

13 April 2015

Posted in

Special research

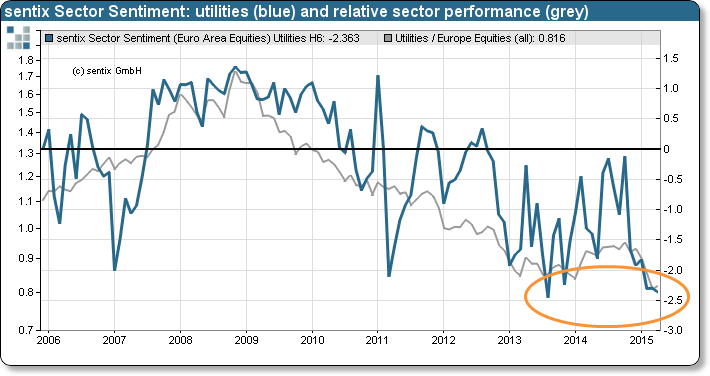

sentix Sector Sentiment for European utilities stocks falls further and now stands close to its all-time low. At the same time the sector’s performance stabilises. As a result, a contrarian opportunity arises.

In April, sentix Sector Sentiment for European utilities stocks falls to -2.4 standard deviations (see “Background” on next page). Currently, this is the worst sentiment among investors measured by sentix (see graph). In addition, the indicator now has almost reached its all-time low dating from August 2013 – which was then the beginning of a longer period of outperformance for the sector (see graph)!

At the same time prices do send positive signals, too: The European utilities future has climbed to a new high in the year running, and the sector’s relative strength now trades in a support zone. Consequently, the present sentiment extreme – which taken for itself sends a contrarian buying signal – also falls on a fertile ground from a chartists’ perspective. The chances that utilities stocks will outperform over the coming weeks are thus rather good.