|

25 November 2019

Posted in

sentix Euro Break-up Index News

Even before the new President of the ECB, Christine Lagarde, will chair her first Council meeting and explain the de-cisions taken at a press conference, investors will form first narratives. One such narrative is that Madame Lagarde seeks to stand shoulder to shoulder with politics. This strengthens the cohesion of the Eurozone from the investors' point of view.

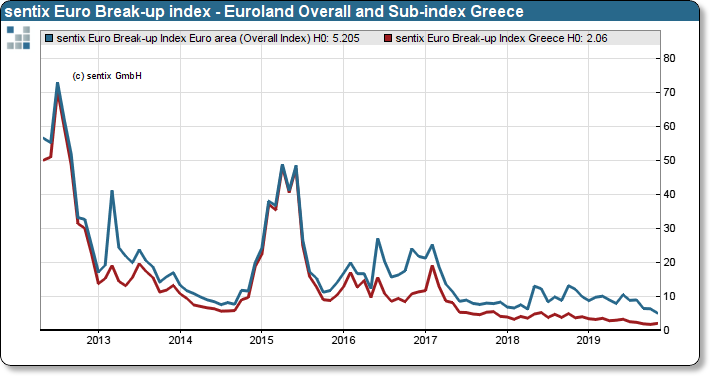

Investors are giving the new ECB President a warm welcome. With an all-time low in the Euro Break-up Index of only 5.2%, they welcome the former head of the IMF to the new office. And this before it is clear which course the ECB wants to take in the future. Due to her former positions as French Finance Minister, investors assume that an ECB led by Madame Lagarde will in the future seek closer cooperation with politicians. And the first public statements by the new President of the ECB point in this direction.

sentix Euro Break-up Index: Euro area Overall index and Greece sub-index

On the surface, this strengthens cohesion within the euro zone. On the one hand, this may dampen the dispute in the ECB Governing Council by holding Lagarde back on monetary policy issues or possibly coming up against critics. On the other hand, it does not seem unwise to relieve monetary policy by making greater use of fiscal leeway. But that is ex-actly where the crux lies. Countries such as France, Italy, Spain, Portugal and even Greece have not gained any room for manoeuvre in recent years. Rising government debt could revive problems that were thought to be dead in the medium term. The sub-index for Greece could remain a remarkable seismograph.