|

29 September 2014

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) decreases in September from 8.2% to 7.7%. It again stands very close to its all-time low registered in July although economic assessments of investors have deteriorated markedly since then. Consequently, investors do currently not expect economic weakness to harm the euro. But the national EBIs of Greece and Italy disappoint nevertheless.

In September the sentix EBI falls slightly and now stands at 7.7%, only one tenth of a percentage point higher than two months ago when the indicator had reached its all-time low. This is, once more, a rather surprising development as investors' economic assessments have more or less collapsed over the summer. In August and September, for instance, the forward-looking sentix economic expectations have fallen strongly for the Eurozone. But the EBI still stands at record-low levels.

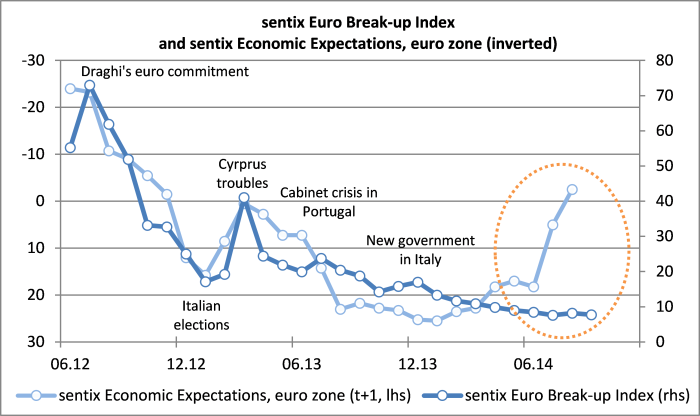

Investors thus do not expect the current economic weakness – which probably will aggravate over the coming months – to be a serious danger for the integrity of the euro. This shows that the confidence in the irreversibility of the common currency has gained a new quality: until spring, improvements in economic assessments always came in tandem with decreasing probabilities of a euro breakup – and vice versa. This correlation has now broken down (see graph). The main reason for this should be the actions of the ECB. Many investors now think that the central bank will buy government bonds on a large scale if an economic downturn leads to more deflationary pressures and with this help the financially weaker euro countries.

But for those who do not believe in this cosy euro story the latest sentix EBI data also present two predetermined breaking points: Greece and Italy. For Greece the national EBI rises against the general trend from 5.7% to 5.9%. Greece thus remains the country with the most investor votes regarding a relatively quick euro exit. Then comes Cyprus with 2.7%. But here the indicator is down from 3.2% and displays an intact downward trend. The third place is then taken by Italy with an unchanged reading over the month of 2.0%.

Things look much brighter for Spain (0.7%) and Portugal (1.0% after 1.9%) whose banking crisis does not seem to play a role anymore in investors' perceptions. Taking the EBI as a yardstick and looking at the yields of 10-year government bonds reveals that Spanish and Portuguese yields still stand at too high levels compared with those of Italian bonds. As a result, the EBIs indicate that Iberian government bonds remain relatively cheap.

Annotation relating to the graph: sentix Economic Expectations are inverted. Furthermore, all readings of the sentix Economic Expectations time series are shifted to a month earlier as this leads to a better fit of the survey periods of both indices. The sentix Economic Index is in most cases published in the week directly following the EBI's publication, but then carrying already the label of the following month, too.