|

31 August 2015

Posted in

sentix Euro Break-up Index News

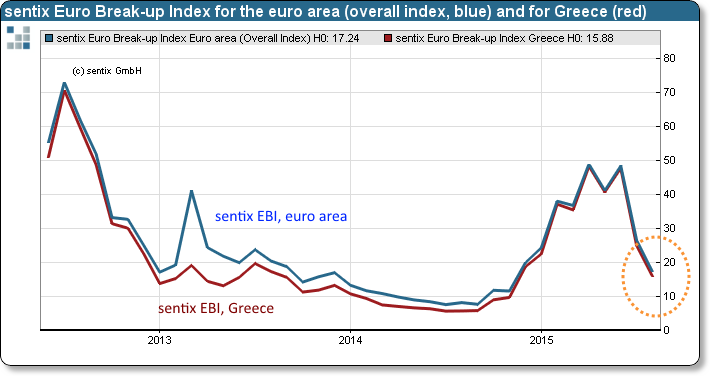

The sentix Euro Break-up Index (EBI) falls from 26.5% to 17.2% in August, its lowest reading since November last year. The development is driven by the fact that an increasing number of investors do not expect a “Grexit” anymore. This makes Greek government an opportunity.

The fading “Grexit” fears are mirrored in the national EBI for the Hellenic Republic which drops from 25.0% to 15.9%, also its lowest level since November 2014. While the political risks in Greece have risen with the fresh announcement of snap elections, the third rescue package for the country has clearly taken shape over the recent weeks (for in-stance by its adoption by the German Bundestag). For the rest of the countries the EBI moves scarcely in August, the exception being Cyprus for which the index decreases to a new all-time low at 2.3%.

This month’s takeaway is thus that first and foremost a strongly growing number of investors expect Greece to be kept in the euro zone. Such a scenario makes Hellenic government bonds rather attractive. Here, the current EBI readings indicate further potential – supposed investors will start to act according to their expectations reflected in the indices. For 10-year Greek government bonds, for instance, the national EBI for Greece – all other things equal – points to yields clearly below 8% – and thus turns them perhaps into to the most interesting trade in the “govies” market at the current juncture.